Taxes in California can take a big bite out of the profits you earn from your rental properties. Real estate investors are always looking for ways to reduce the tax impact on their income. While it’s unlikely to completely avoid paying taxes on rental income, with the right strategies and a solid understanding of California’s tax regulations, you can significantly reduce your tax burden.

Rental Income and Taxes in California

In California, rental income is taxed as ordinary income, both at the state and federal levels. State income tax can be as high as 12.3% for those in higher brackets. This applies to all forms of rental income, including rent payments, utility reimbursements, and any additional fees charged to tenants.

At the federal level, rental income must be reported on Schedule E of IRS Form 1040. After deducting eligible expenses—such as property taxes, mortgage interest, insurance, and depreciation—your net rental income is then subject to federal taxes.

California doesn’t offer a separate tax treatment for rental income, so if you’re in a high-income bracket, expect a hefty tax bill. However, by taking advantage of credits and deductions, you can lower your overall tax liability.

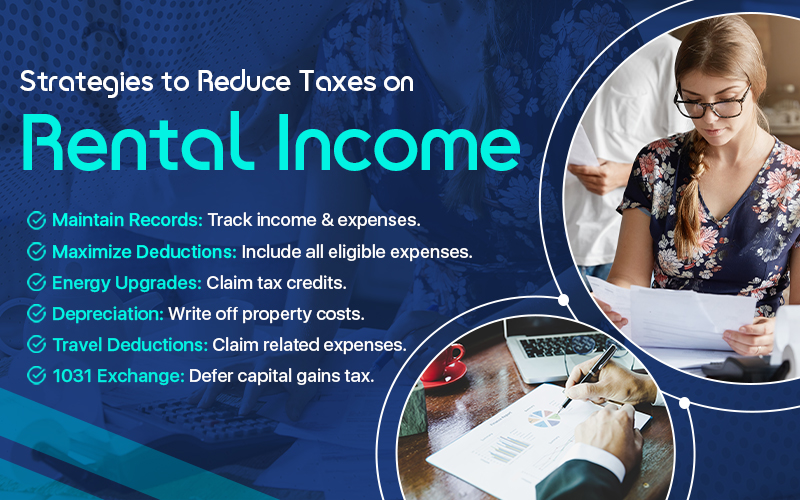

How to Reduce Taxes on Rental Income

To reduce your tax liability, you must leverage all available deductions and tax strategies. Here are some key approaches to consider:

-

Maintain Detailed Records

Accurate and comprehensive records are essential for minimizing your tax bill and claiming all available deductions. Keep track of all rental income and expenses. This will not only maximize deductions but also ensure you’re prepared if you ever face an audit. If necessary, consider hiring a bookkeeping service or using accounting software designed for rental property management.

-

Maximize Deductions

One of the most effective ways to lower your tax bill is by maximizing deductions. Deductions may include property taxes, mortgage interest, insurance, utilities, property management fees, maintenance, and repairs. These expenses directly reduce your taxable income, helping to lower the amount you owe.

-

Invest in Energy-Efficient Upgrades

California offers many rebates and incentives for making energy-efficient upgrades to your rental property. Improvements like energy-efficient windows or solar panels can qualify for tax credits and rebates, reducing your tax liability while also boosting your property’s value.

-

Take Advantage of Depreciation

Depreciation is a non-cash deduction that allows you to write off the cost of your rental property over time—typically 27.5 years for residential properties. This can significantly reduce your taxable rental income without affecting your actual cash flow.

-

Deduct Travel Expenses

If you need to travel for the maintenance or management of your rental property, you may be able to deduct expenses like airfare, meals, lodging, and mileage. As long as these expenses are directly related to your rental business, they can be deducted from your income.

-

Utilize a 1031 Exchange

A 1031 exchange allows you to defer paying capital gains taxes when you sell a rental property by reinvesting the proceeds into a similar property. This way, you can delay paying taxes on the capital gains, allowing you to reinvest more of your profit into future properties until you eventually sell the replacement property.

Conclusion

In California, rental income is taxed just like ordinary income. While avoiding taxes altogether isn’t realistic, you can significantly reduce your tax liability by employing smart strategies and taking full advantage of deductions and credits.