For many new small business entrepreneurs, the first year is actually the hardest. First, you need to decide what form of business you actually want, then there’s extensive business record keeping.

Bad record-keeping can be a big pitfall if you are a small business owner. You can avoid headaches when you are filing your tax return, keeping business records for tax purposes becomes useful. You need to keep the records all through the year.

Everyone in business must keep tax records for small business. Good business records will surely help you do the following:

Monitoring the progress of the business

You definitely need good records to monitor your business’s progress. Records can show whether your business is improving, which items are selling or what changes you need to make.

Do you know that good records can actually increase the chances of business success? But, how to find business tax records? Read on and you will find out.

Project the estimated tax payment

During the first year of business, you will need to project the tax liability so that you can make the estimated tax payments. Estimated tax is the method used to pay tax on come is not subject to withholding.

When you are dealing with tax preparation, keeping the business records can actually be a lot of help. Estimated tax is used to pay income tax and self-employment tax, as well as other taxes and amounts reported on the tax return.

Preparing the financial statements

You need good business records for tax purposes to prepare accurate financial statements. These include income such as profit and loss statement as well as balance sheets. These statements can really help you deal with the bank creditors and manage your business, well.

Preparing the tax return

You also need good business records to prepare tax returns. These records support the expenses, income, and credits you report. Now, these are the same records you use to monitor the business and prepare the financial statements.

Now, you may wonder how to find business tax records. This is easy. Every business leaves a paper and electronic trail of tax records, business licenses, corporate filings, financial statements, etc.

If you are a small business owner, you can find tax records information online and hard copies at government offices.

So, once you know why you should keep business tax records, your next questions may be how long should you keep it. Let’s see.

How Long Should You Keep Business Tax Records?

Good business recordkeeping allows you to prepare the financial statements, helps you keep tabs on the expenses as well as comes in handy in case you get audited or sued.

But did you know the IRS requires you keep the business records for tax purposes? Let’s find out which records you are legally allowed to keep and how long you must keep it. Also, how to ensure that you don’t lose it, at all.

| Record type | How long to keep it |

|---|---|

| Previous tax returns | 3 years |

| Receipts | 3 years |

| Miscellaneous financial records | 3 years |

| Employment tax records | 4 years |

| If you omitted income from your return, keep records for.. | 6 years |

| If you deducted the cost of bad debt or worthless securities, keep records for.. | 7 years |

The Eight Small Business Tax Record Keeping Rules

You never know which record you need when dealing with tax preparation, so keep these handy.

- Always keep bank statements, receipts, payroll records, invoices, receipts and any document that supports an item of deduction, income or credit shown on the tax return.

- The most supporting document needs to be kept for at least three years.

- Keep employment tax records for about four years.

- If you omitted income from the tax return, ensure you keep the records for at least six years.

- If you deduced the cost of bad debt, keep the records for up to seven years.

- It is better to get the documents electronically backed up and go paperless.

What receipts to keep for taxes?

As much as you live by your words, the IRS requires that you keep documentation that includes your income, deductions, credits you report on the tax return.

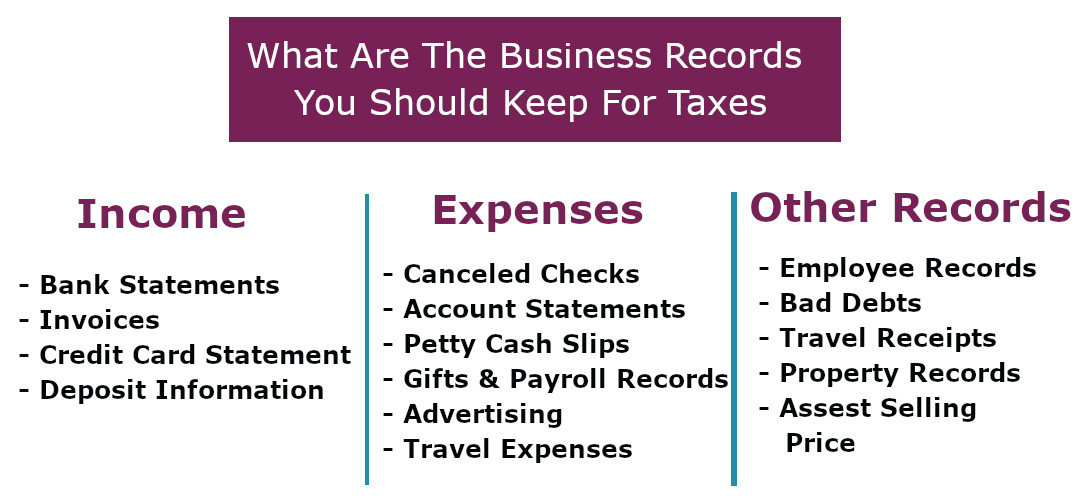

Here are the main records you must keep for tax preparation:

- Cash register tapes

- Receipts

- Deposit information such as cash and credit sales

- Invoices

- Credit card receipts

- Bank statement

- Tax filing

- Payroll records

Are there documents you don’t need to keep?

It is impossible to keep all the documents. Receipts at times get lost, especially for small expenses. But can you still claim those receipt-less expenses as tax deductions?

Maybe, but the expenses need to be less than $75. You can get away with not keeping tax records for small business for three reasons:

- The expense is less than $75. (This isn’t applicable for lodging expenses)

- The expense is for transportation and it is not possible to have a proper receipt.

- You are reporting meals and lodging expenses under an accountable plan.

Wait, in order for the IRS to uphold a deduction under $75 without any receipt, you need to present them with:

- The expense amount

- Where and when it was made

- The essential character or purpose of your expense

The easiest way to keep the records

The IRS suggests that you can use any recordkeeping system as long as it shows your expenses and income. However, the IRS accepts digital copies of documents as long as they are identical to original copies.

No wonder, digitizing the records is the best way to prevent accidentally tossing them in the trash can. Also, paper records can fade and are susceptible to damages.

It is better to scan each record and receipt in your business and archiving forever.

Concluding words

When dealing with tax preparation and wish to avoid the IRS audit, it is better to stay sorted. One of the most important things is to keep the necessary business records. So, before tossing them up, double-check whether you or anyone else you do business with might need it.

Contact Us Today:

Locations: