Types Of IRS Installment Tax Agreements And Plans?

Owing money to the IRS is common for every working individual across the US. However, several affected individuals aren’t aware of the IRS installment agreement plan & payment options available to them.

The IRS has set up payment options that can be applied to people in various financial situations. This is established through a proper payment plan, which is often the agreement between the IRS and the individual in tax debt to pay the tax amount owed within a mentioned time frame.

Depending on the amount owed and the individual’s ability to pay the sum total to the IRS, one can either opt for full payment or an IRS installment agreement online. There are rules and regulations that govern and help you determine which payment plan you must opt for.

This blog elaborates on the types of IRS installment plan that would assist indebted taxpayers to pay the taxes easily.

Guaranteed Installment Plan

The guaranteed installment plan is a monthly installment agreement between the taxpayer and the IRS which is based on qualification. The qualification is determined after the taxpayer makes the request to the IRS and succeeds.

Wondering how to pay IRS tax installments? To qualify, the taxpayer needs to meet the requirement:

- The taxpayer needs to owe less than $10,000 including interests and penalties accrued on tax payments owed.

- The taxpayer must indicate an inability to pay the tax liability when it is due or within 120 days.

- The taxpayer must also show filed tax return, payment of taxes initially owed within the preceding five years and no current entry into an installment agreement.

- She or he must be able to show they are not at all bankrupt.

- The taxpayer must indicate their ability to pay taxes in installments within three years.

As per the IRS approval, a taxpayer using the IRS installment plan is free from a federal tax lien. The guaranteed installment agreement is easy to apply and acquire since it assured by law once the taxpayer meets the requirements.

Another benefit is that you can pay as little as $25 or lower. However, it is advisable to pay as much as you can during the agreed-upon time to avoid increased interest and penalty payments.

Streamlined Installment Plan

The name of this IRS installment agreement online is based on the verification requirements. The streamlined IRS installment agreement doesn’t require one to verify their expenses, assets, debts, and income. This means that no information is needed, making it quite convenient.

It is common for qualified taxpayers to be eligible for applying for a streamlined IRS installment plan as well. The installment agreement requires the following for you to qualify.

- Your collective tax liability, accumulated interest, and penalties must not be over $50,000.

- You must indicate your ability to pay the balance within 72 months and a maximum of 84 months.

- Your proposed payment must be greater than $25 or the least amount got when your liability, interests are divided by 50.

- He must not be filing for bankruptcy.

- You must also show willingness and ability to pay for the streamlined installment agreement fee which is considered as the initial payment.

Partial Payment Installment Plan

Confused about how to make payments to IRS? Partial payment is also an option for you.

If you don’t qualify for the streamlined installment agreement, the partial payment agreement plan is the next option.

However, remember you need to avoid IRS tax audits by making proper payments. Thankfully, the IRS gives you chances so that you can choose the payment plan.

The installment agreement requires you to divulge the financial information to the IRS. You can do so by completing the financial statement using the right Form that records information on assets, debts, etc. Now, the IRS on receiving this information reviews and verifies the information provided.

Additional information on assets that can be liquidated to pay part of the taxpayer’s tax liability is required by the IRS.

For the partial payment installment plan, the following is required:

- Your tax liability penalties, interest must be accumulatively above $10,000

- All the past tax returns must have been filed prior to application

- You shouldn’t have accepted the offer in compromise

- You must have filed Form 433 for the collection information statement and installment agreement request.

Offer In Compromise

The Offer in Compromise is a rather unique installment agreement between you and the IRS which allows you to settle the tax liability at a lower amount than what you actually owe. Taxpayers who can afford to pay taxes in installments aren’t eligible to apply for offers in compromise.

The major basis for an offer in compromise is a determined scenario by the IRS that establishes the taxpayer’s accrued tax debt is greater than the reasonable collection potential.

- To qualify for offers in compromise the taxpayers needs to show:

- The taxpayer must file all the tax returns

- The estimated tax payments for the current year needs to be made

- You must make all tax deposits for the present quarter in the event that you own a business with employees.

Keep these in mind and consider the type of agreement you want to opt for.

|

Struggling With The IRS?Are you facing any other challenges with IRS? Give us a call today. We’ll be happy to help you set one up.

|

Why Should You Keep Business And Personal Account Separate?

Small business owners should operate in a business to realize the tax breaks at their disposal. For example, if you meet the requirements, you can deduct necessary and ordinary business expenses.

But business owners often find themselves in tax trouble when they mix business with personal matters. This mistake is also a prime target for IRS scrutiny in audits.

You must keep your business account separate from personal account for various reasons. The accountant helps you with this matter.

Why Not Mix Business And Personal Accounts?

There are reasons illustrated stating why it is not a good idea to mix business and personal accounts:

- It doesn’t look professional: you are dealing with a customer and pull out a personal checkbook or credit card to pay a business expense. Now, this gives the impression that you are not the real business owner.

- In the same way, lack of separation screams “hobby” to the IRS. The IRS is quick to deny deductions and losses for hobbies. If you want the IRS to look at your business as legitimate and not any hobby, keep the personal and business accounts separate.

- Your income and business deductions don’t have a distinction. If you want to claim expenses as deductions, you must be able to show these deductions were for the business purpose.

- Sorting personal records during tax time can become a nightmare. Capture the business expenses in your business account to make it easier to claim the deductions.

- You may get audited by the IRS. Now, the IRS is likely to audit the business and deny deductions and business losses. This happens if you don’t have a clear separation between business and personal expenses.

If you have a home-based business, for instance, the IRS may not allow home business expenses if they are not separate.

Small business accounting services can help. The experts know how to offer you the assistance so you can separate the business account from the personal one.

-

Arms-length transactions

All transactions between you personally and the business should be an arm’s length. This means, the transactions clearly separate you as the personal entity and the business as the entity.

-

Keeping distinct accounts

Most importantly, set up separate checking accounts for business and personal use. You must write checks for business purchases from your business account and personal purchases from the personal one.

In other words, put business income in the business account and personal income in your personal account. Keeping the business account separate from the personal matters.

-

Make this official

Consider establishing a limited liability company (LLC) or an S Corp for your business.

Sit down with your accountant and determine what entity makes the most sense, how this business will impact the taxes and financial plan, etc.

The business entities will give your personal finances a new level of liability protection, that must come in handy if the business gets sued.

-

What if you make a mistake?

To err is human. Just ensure you document the mistake and edit the transaction in the business records. For instance, if you deposit a personal check in the business account, label it as owner’s equity.

If you need to take the money back out, enter the check as the draw on your owner’s equity. When you forget to pay for something with the personal credit card, consider it an investment.

Every transaction should have proper labels, at arm’s length, and reasonable.

How To Separate Personal And Business Accounts?

Luckily, small business owners who haven’t separated their expenses can still do so by following some tips:

-

Register The Business

The first step to separate yourself from the business is officially registering the business.

There are several business structures you can choose from. Your accountant will help you pick the right one as per your need. Incorporations offer the strongest protection to its owners from personal liability, enhances the business credibility and gives easier access to capital.

However, incorporations also come at a higher cost than other business structures, including high taxes, etc. Ensure you do your research on business structures before registering.

-

Open The Business Account

An efficient way to separate the personal and business accounts is to divide them into separate, designated bank accounts.

After you receive the EIN, open the checking and savings account in the business’ name. The number of banks requires an EIN to open a business account. Conduct the transactions through business accounts.

Bottom Line

Finally, it is mandatory to keep business account separate from personal. Diving your personal and business finances is the first step to transforming the idea into a reality.

After your small business becomes a registered entity, a business becomes a reality. Separating finances will help ensure it succeeds.

Contact Us Today:

Locations:

How to Respond to A Letter or Notice from the IRS?

The letter one expects from the IRS is a refund cheque. However, it doesn’t happen in most cases, and the letter you get from IRS often relates to the tax return. Over here, the point of discussion is how to respond IRS letters.

IRS communicates directly with the person they believe has done something wrong during tax return. In case IRS sends you a letter, there is nothing to get panicked. You need to go through the letter or notice to understand the reason for contact and the way to proceed further.

But before, telling you the ways to handle the IRS letter or notice, you need to understand why IRS sends you the notice?

Here are some reasons for which IRS sends Notice:

- You have a balance due

- You are due a larger or smaller refund

- We have a question about your tax return

- We need to verify your identity

- We need additional information

- We changed your return

- We need to notify you of delays in processing your return

Remember, IRS do not for ask money, unless you are doing some mistake. Now, as you already understand the reasons for getting the notice, you are thinking about how to reply IRS letter. So, here are steps that you need to follow.

Nothing to get panicked

You need not panic one you get a letter or notice. Carefully read the letter or notice. Most of the letters contain the process one needs to follow. Further, all the notices give ample time to the tax payers to deal with the matter. Most of the notices resolved only after one or two discussions. However, irrespective of the reason for sending the letter, most of the notices are not a call for alarm. It is important to know how to respond IRS letter

Confirm the Authenticity

Several fraud IRS scams are reported in recent times. Thus, once you get a letter from the IRS, you check its authenticity. You can call the IRS to verify that is it sent by them or not. If IRS mailed you, then they will agree and instruct you for the further. However, if the IRS did not send you anything, then they will help you find out the scammers.

Read Carefully

If the IRS mailed it, then as mentioned, it is important to read out the notice carefully. Most of the notices are about the federal tax return. However, the notice is related probably any specific issues such as changes to tax payers’ account. The notice may ask you about more information such as you owe tax and that you need to pay the amount that is due.

The notice also comes with the process to deal with the matter. So, reading the notice carefully solves your half of matters. If you are still not understanding how to reply IRS letter, then you must contact your accountant related to it.

Take the Action

Once you went through the letter, now it is time to take the action. You know the action that you need to take as mentioned in the notice. However, you must not ignore it by any means. Your ignorance may make the IRS take other steps against you.

You can directly call the IRS office to know more details process regarding how to respond IRS letter. You can also take the help of the accountants for this.

Reach Out to IRS with Your Response

If you agree with the notice, you need not respond with an explanation. You need to fill up the Notice CP-2000 form along with the proposal to adjust your income and credits or deductions. Once you fill the form and send it to the IRS, they will make the changes.

However, in case you are not happy with the notice from the IRS, you can inform them. However, in such a situation you must not fill CP-2000 response form. You can send a separate document including:

- The reasons you disagree

- Your phone numbers

- Best time to reach the IRS

Keep the Copies

Keep all the copies of the letters and document that IRS mailed you. However, you must also keep the copies of the replies you mailed them.

Bottom Line

There is nothing to panic once you get a letter from the IRS. You need to go through the letter and decide how to respond IRS letter. You can take the help of professional accountants who know how to deal with this.

|

A letter from IRS makes you tensed? Do you receive a letter or notice from IRS? Are you tensed about it? You do not need to be tensed as IRS letter may come for any reason. Get in touch with us to further proceed with the letter officially.

|

Contact Us Today:

Locations:

Year-End Tax Planning Hacks for The Small Business Owner In 2019

Taxes for small businesses can be confusing. Several questions are there roams around the mind. Confusion is not an unnatural thing. Few Questions comes to the mind such as:

- How much do I pay?

- Why do I have to pay this amount?

- How can I reduce taxable income?

However, it is better to do year-end tax planning to avoid these confusions. Preparing everything from the starting helps to win the game at the end. There are 70000 pages in US tax code, and it is impossible for a business owner to go through all these.

The current post includes a small business year-end checklist that can help you save tax money.

Adjusted Gross Income (AGI)

Many tax breaks, limitations, and additional taxes tee off of adjusted gross income (AGI) or modified adjusted gross income (MAGI), which for most filers is the same as AGI. One can enjoy a 0.9% additional Medicare tax unless the AGI exceeds $200,000. The limit exceeds $50000 more in case of being married and filing a return together.

Review the Tax Withholding

In the case of tax withholding, one may suffer issues. Therefore, while you are doing year-end tax planning, you must review it. The tax reforms can change your tax withholdings. It’s not too late to make an impact this year, and you can also make changes for 2020.

Review the Business Structure

The tax amount largely depends on business entity formation. If you have 2019 year-end planning ideas in mind, then you must think about the entity formation as well. It will help you save a good amount of tax.

A big change in the tax law in this year decides how business entities are taxed. Corporate tax rates were cut, and pass-through entities will get a break. Structure your business now to avoid a good amount of money. Remember, in business, a single penny also counts.

Use the Accountable Plan

If you pay for the travel, entertainment, tools, or other costs to your employees, then it is recommended that you must continue it further. However, use a plan that is permitted by the IRS known as an Accountable Plan.

Using this plan, you can deduct the amount from the business, but these reimbursements will not be recorded as income to employees. It will save company employment taxes and lower taxable income overall.

Give your employees an accountable plan for reimbursements. It can help your employees save money, as well as help your business — it’s a win-win.

Plan Smart Tax Deductions

Several ways are there to save tax money. However, it depends on the company that will select the usual ways or will go for smart tax selection. While doing year-end planning, you must have to be strategic in your choice.

For example, one can deduct up to $1million for gaining machinery and equipment for the business. Those who are startups can ask their accountants to put the cost under the depreciation. Further, one can claim disaster losses happens like that. A business can also deduct the business insurance amount that they pay every year. IRS Form 1040 can help you determine the business insurance deduction.

Write off Bad Debts can save taxes

One can write off the bad debts prior to the year-end. In addition, you can use the uncollected debts for lowering your profits. During the year you have some accounts receivable which you face difficulty to collect.

During the year-end, if you find that a customer did not pay you for a long time, you can write off the balance amount from the total. You can add all the bad debts to avail a tax deduction. However, you must sit with your accountant before adding to the list.

Final Words

Therefore, over here you have seen the ways year-end tax planning can save a good amount for your small business. However, it is always a good idea to hire a professional to maximize the benefits.

The Ultimate Checklist for Small Business Accounting

Managing a small business may sound a small task, but it is exactly the opposite. One of the prime reasons behind it is the workload that a small business owner needs to handle. Among the different works, it is the accounts which remain neglected in most of the cases. Small business accounting is not difficult to manage if one will move systematically.

It is better to make a checklist if you want to handle your works all alone. Over here in this post, four different checklists are given that will help you to manage your accounts work without any kind of hassle. The accounting checklist is divided into five parts as follows:

- Daily Accounting Tasks

- Weekly Accounting Tasks

- Monthly Accounting Tasks

- Quarterly Accounting Tasks

- Annual Accounting Tasks

Here are the details of the checklist

Daily Accounting Tasks

Any business runs on the cash, and you cannot overlook the inflow and outgoing cash. It is important to check the cash amount that you have in your hand. Additionally, the checking helps you to understand what amount you are going to receive or need to pay to others. Keeping these in the mind daily can help you in maintaining day to day affairs.

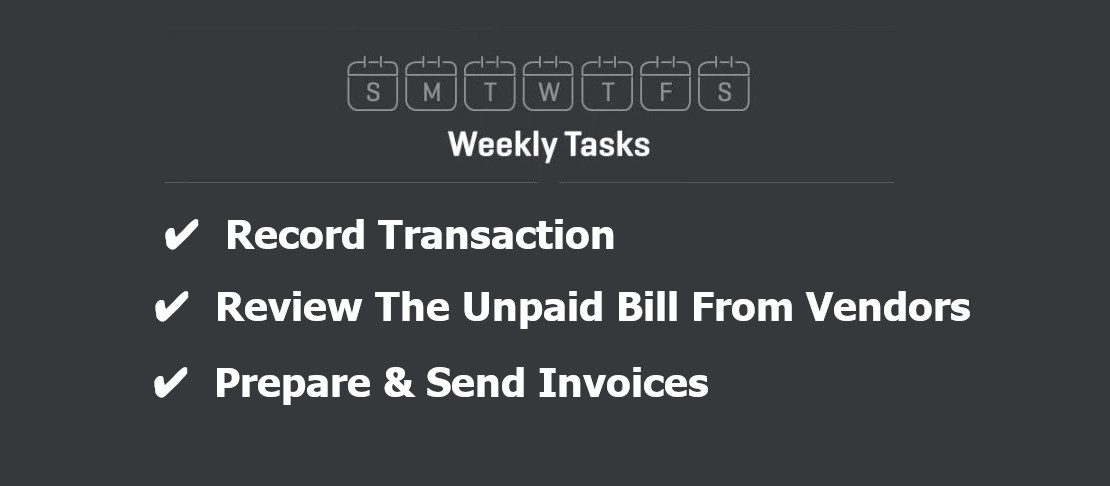

Weekly Accounting Tasks

Record Transaction

Recording all the transactions such as billing customers, receiving cash from customers, paying vendors, etc. are essential for small business accounting. You should keep the records at least weekly to ensure the smooth running of your business. Using bookkeeping can help you in this matter.

Review the unpaid bill from vendors

One must keep a separate folder for unpaid vendors. You should keep track of the amounts that are needed to pay. Few vendors offer a discount on early payments also.

Prepare and send invoices

You must ready all the invoices during the weekend. It is a good idea to prepare the invoices, and send them in the weekend as during the week you might remain busy.

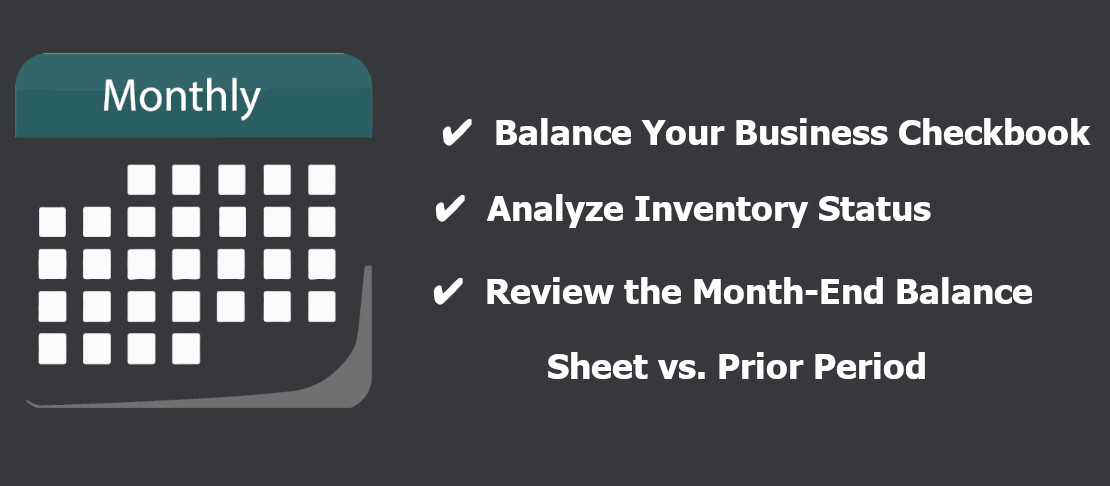

Monthly Accounting Tasks

Balance Your Business Checkbook

Once a month, you must look at the checkbook of the business. You will be able to understand that the cash inflow and other transactions are okay in that or not. You can also be able to know that all the transaction and entries are done in the right manner or not.

Analyze Inventory Status

In case you are having any inventory then you need to look at that at least once in the month. A regular check can help you in making the adjustments during small business accounting as you will neither have a shortage or overload.

Review the Month-End Balance Sheet vs. Prior Period

By checking the balance sheet of the current period with the early period, you can get a possible picture of the business that you are running. You can be able to point out where the business is lacking and can manage it.

Quarterly Accounting Tasks

Prepare/Review Revised Annual P&L Estimate

You must revise and review all the annual estimation. You should also assert that do your assets are going up or down, the difference between revenues and expenses, etc.

Review Sales Tax and Make Quarterly Payments

You should also look in matters like tax and quarterly payments of the taxes. The U.S. Small Business Administration (SBA) can help you determine your state tax obligations.

Annual Accounting Tasks

Fill Out IRS Forms W-2 and 1099-MISC

You must fill and report the annual earnings of your full-time employees (W-2s) and most independent contractors (1099s). For any contractors who earned less than $600 a 1099 form is not required.

Review and Approve Full-Year Financial Reports and Tax Returns

You must check all the documents finally before you submit the tax returns finally. For a smooth small business accounting, you should hire a professional accountant who can help you in the tax preparation and internal accounting.

Contact Us Today:

How Much Should You Keep Aside For Small Business Tax?

Not quite sure how much you need to save for small business tax? There are many ways to go ahead calculating what you actually owe and saving the right amount.

The right method to use would depend on how long you have been in the business, how stable the income, how willing you are to crunch the numbers, etc.

Now, if your business is losing more than it is making, you need to pay tax! Moreover, if your business is making money, here’s how you can save in this tax season.

Hiring experienced professionals offering tax services can be of great help.

First Step: Get Clear On Your Tax Obligations

In the guide, we have come up with methods that would help you set some money aside for the taxes your business actually owes. It means your self-employment tax as well as income tax that you and your business, most likely pay the IRS on a quarterly basis.

When you hire employees, you would need to deal with employment taxes. But the federal taxes are just a tax pie. Also depending on the nature of your business, you might have to pay a variety of local and state taxes.

For instance:

- Sales tax: Most of the states actually charge you sales tax that you collect at the time of making a sale.

- Franchise tax: If you have sales tax nexus in any state, the state might charge you a franchise tax. But how this tax would be calculated differs in every state.

- Property tax: Charged on real estate you or your business operates, property tax actually varies state by state.

But you need to consider that this list is not comprehensive. The only sure-shot way to determine the business’s tax obligations is to work with a qualified CPA. They help you and outline what the tax services your business needs and guide you on how and when to pay.

Tip: it is your responsibility to set the money aside for all the taxes the business is obliged to pay- federal or state- all through the year.

Second Step: Just Use 30 Percent Rule To Save For Taxes

In order to cover federal taxes, saving 30 percent of the business income is the rule of thumb. It has been found that the total amount you must set aside to cover state and federal taxes must be around 30%-40% of what you actually earn.

Now, tax obligations differ from one business to another. If you would like to get granular or see if you can get away with saving less than 30%, you must talk to your CPA.

He would help find what percentage of the business income you save to cover taxes.

Third Step: Choosing The Proper Saving Method

You must set aside money for the small business taxes as often you can. The best savings method for your need would depend on what type of business you run as well as how long it has been operating.

The per payment method- this method makes real sense if you haven’t been in business for real long, or if this is the first year filing the tax return for the business.

The monthly method- this is the best to if this is this is the first year of your business that has turned profitable.

The yearly method- if you have filed tax return for the business last year and don’t expect the business to change a lot this year, you can opt for the yearly method.

The hired CPA can actually help you choose between these payment methods of tax services.

What Happens If You Underestimate The Tax Owed?

As per the rules set by the IRS, as long as you pay 100 percent in the present year of what you paid the earlier year in quarterly estimated tax, you wouldn’t be penalized for underpaying. Yes, even if the amount is too low you wouldn’t get penalized.

Accountants Can Serve You in More Than Just Tax Returns: Know How

A common conception plays in the mind of the people that one need to hire accountants to get help in tax preparations. However, it is important that one must know that the accountant is hired for more than the tax returns and accounting services only.

Following statistics are enough to prove that the need for accountants in CA itself. Nearly 143,670 numbers of accountants are being employed in the year 2017 alone. The number suggests that small businesses are looking for an accountant for more than just tax returns.

Another data shows that CA, Texas and New York employed the greatest number of accountants by May 2018, that is 360,000.

Therefore, you can see the rise of employment of the accountants in the US. However, this is not only because of tax issues but something more.

Before you search for “accountant near me”, there are certainly more reasons to hire accountants for your local business.

Saving Your Quality Time

Modern business is running faster than imagination. Here time can only be calculated by money. So, in such a situation, you cannot afford to lose time. The truth is that accounting consists of a lot of paperwork.

It is difficult for a business owner to focus on the work along with focusing on the accounts. Therefore, hiring an accountant for the accounting services is a better option as the accountant is well aware of the latest tax laws, rules and regulations, and deadlines.

Therefore, it can save you precious time that you can invest in the betterment of your business.

Prevent You From Paying Fines

While you are appointing an accountant, the accountant will ensure all the records to remain updated. With updated accounting, you can be sure that you will not have to pay any fines.

The accountant will ensure the payments of all the taxes on time, which will save your time and money for sure.

However, a tax fine can range between $150 to $1000. Therefore, stop thinking and start to search for an accountant near me over the internet.

Easy Decision Making

While you are hiring the accounting services the best thing will happen to you is to remain informed about the accounts. It will help you to know the financial condition of your business.

While you are aware of the positions such as cash inflow and expenditure, it will help you to do future planning.

By the year-end, a well-prepared accounts book will help you to take a constructive decision in the betterment for the business.

Tracking The ROI

It is important that one must keep an eye on the ROI. You are investing your hard-earned money on advertising and what about the returns?

Unless your investments are returning in the figures for sales and revenue generation, it will be nothing but a wastage of investment.

By hiring an accountant, you can track the success rate of marketing campaigns by analyzing sales figures and the number of new customers versus the total cost of outreach. So, don’t waste much time to try to search for a nearby accountant.

Managing The Payroll

Often in case of small and mid-size businesses, managing the payroll can be a daunting task. However, an experienced accountant can manage the payroll also.

A good accountant knows what to look out for and will advise you on your specific situation. An accountant knows well the deductions and overtime wages. Therefore, the chance of error is very less.

Concluding Words

Therefore, in the current post, you have seen that accountants can do more than just tax handling. In case you want to add something more to the list, message us.

In case any need for accounting services related help, please get in touch with us now.

|

Get more than Tax Issues Accountant can help you with more than only tax issues. From financial forecasting to managing payroll swiftly. Accountants can do all for you. Need one?

|

What May Occur in Case of Not Having Proper Bookkeeping?

Do you know that in 2018 alone there were 1.26 million accountants and auditors and 1.53 million bookkeeping services, accounting and auditing clerks employed in the U.S? Surprisingly, it is the state of CA that employed the most accountant and auditor in 2018.

It presents a picture that shows the need for maintaining the accounts properly. However, it is known to us that the costs of Accountants and CPAs are much higher than of the Bookkeepers.

However, just because of not hiring the bookkeeper at the right time, often small business also needs to hire Accountants in the later time. Several other problems may occur also in case of not hiring a bookkeeper on time.

In the next few paragraphs, you will be able to know the sequences which may occur in case you do not have proper bookkeeping or how can bookkeeping help your business.

The finance will be left obscured

Without proper bookkeeping services, it is difficult to get a comprehensive picture of the financial viability of your company. In the absence of the proper records, tracking the cash flow projections and statements is next to impossible.

Now when you cannot measure the cash flow accurately, you will face the difficulties with invoices overdue, held inventory, or recurring variable expenses like shipping costs or hourly wages. Without a clear understanding, reaching the breakeven will be difficult.

Can cause costly mistakes

As you are getting obscure ideas about your financial situation, it may lead to the next level that is to do costly mistakes.

It is obvious, as you are running out of the exact amount of inflow and expenditure, so making the mistakes are going to be very common.

Overestimation of the profits can also lead you to audit and fines. Wrong categorizing assets (such as, long-term assets that depreciate over time) and expenses can lead to your paying more in taxes than you need to.

Increase the chance of being audited

As mentioned, when you are doing mistakes it will result in increasing the tax payment. An improper or late filing of return can lead you to some vulnerable situation.

In case the IRS found wrong exemptions, expenses, or deductions, they can take the initiative of doing an audit.

Now imagine that during the audit if you cannot produce the all-important documents as you didn’t record it in bookkeeping book, then what will be the consequences. Remember that any matter of irregularities will be found during the audit, it may turn into serious consequences like penalties.

Read: Quick Guide Of Bookkeeping

Limits your Financing options

Imagine your situation after being penalized by the IRS. In case of even in the need of a loan will you be able to get it?

Messy bookkeeping and accounting services can lead your options closing. Especially, if you are a small business owner, such bad bookkeeping his can lead to bigger problems.

In order to get loans, you must make sure that you have accurate, up-to-date financial records. Bookkeeping for small business is very essential. Do not let a bad or not having any bookkeeping to ruin your prospect of getting loads.

Minimizes the Tax Deduction

What do you do to claim the deductions? You need to file the documents to claim it. However, in most of the cases, where there are no bookkeepers, the chance of getting the important things to be misplaced become high.

In case you will not have the valid documents with you, you will not be able to claim the deduction for them either.

Even if you hire an accountant, it is not possible for him either to spot the deduction in the absence of the booked documents.

Final Words

Therefore, you have seen that in case of not having proper bookkeeping services, the range of problems that you can face.

|

Fear of Audit & PenaltiesAre you facing any other challenges due to not having bookkeeping? Do not be worried about being penalized by IRS

|

How can outsourcing the payroll services can benefit your business?

Several business houses in the US used to outsource their payroll service. But why? What benefits did they get by outsourcing it? Here you will know the reasons for which business outsource their payroll services.

But who can provide payroll services? Generally, it is better to go for certified CPA as they have the proper knowledge on this matter.

As per a recent survey conducted by Financial Executives Research Foundation, nearly 39% of US business used to outsource their payroll process.

The same survey also mentioned that 43% of the business used to outsource their payroll tax responsibility.

Before dig deep into the benefit, it is important to know how do payroll services work?

Payroll is associated with recording the compensation of the employees. It can include the followings such as:

- Wages

- Salaries

- Commissions

- Bonuses

However, it also includes the accounting of the taxes that are withheld. Examples:

- Federal withholding taxes

- State withholding taxes (if applicable)

- Social security taxes

- Medicare taxes

Generally, big business houses used to have their in-house payroll management, but most of the small and medium business are opting for hiring professional payroll services providers.

But what are the reasons for such outsourcing? Here are some of the benefits.

Time saver

A payroll service includes various accounting process as mentioned above. Therefore, it needs a huge dedication and time to do it in detail.

Each time the person responsible for it must type in large amounts of data and double-check any key errors. So, a huge workable time is lost.

On the contrary, when you outsource the payroll services, you get the time to focus on revenue generation and better customer services.

Money Saver

On hearing the term outsourcing, the common question comes to mind is how much payroll services cost?

Here you need to understand that in modern business, time is money. When you are saving your precious working time, it means you can utilize it for constructive works for your business.

Additionally, hiring in-house payroll services will nothing but incur a huge cost and liability. On the contrary, when you are outsourcing the payroll, you don’t have to take any headache.

Security Matter

Undoubtedly payroll services are complex matters. It is related to every single confidential data of the company and its employees. Therefore, trusting a singular employee with it can be a risky decision as there are chances of tampering and theft of data.

Buying the payroll software can be a cheap option, but how can you guarantee the safety of your data? It is possible that after a few years another business house will buy that same software.

Additionally, will the software company be able to guarantee you the safety of your data on their server or network?

On the contrary, hiring professional payroll services is a safer option. You can get the physical access of them at all the time. Being a third party, they always keep your data confidential and safe.

Stay updated with the government policy and regulation

CPA is the best option who can provide payroll services as they remain always updated regarding government policy and regulation. It is not possible for a business owner to focus on all the details of government regulation.

However, missing or misinterpretation can make the business owners held legally responsible. It can lead to even audits and penalties by the IRS.

Related Article: What You Must Know About the Payroll Mistakes?

In 2016 alone, 1.8 million tax returns were audited whose income was between $200,000 and $1 million. 978,564 businesses of all sizes were assessed civil penalties.

By hiring a professional, you surely avoid these problems.

Concluding Words

Therefore, you have seen the benefit of outsourcing your payroll services. However, in case you want to add anything, feel free to comment.

If you are looking for payroll services, get in touch with us.

How Can You Calculate Small Business Liability?

Finding out how much federal tax you owe is really complicated, most small business owners actually ask CPAs to do it for them.

But even after hiring a CPA, it is still essential to know the mysterious art of calculating the own taxes. You should be able to plan ahead, save money on CPA billable hours and never enter the tax season cluelessly.

Quick Look At How To Calculate The Tax Liability

When finding out how much federal tax the small business owes, you must start by determining the entity type. If your business is a C corporation, you need to pay tax twice, at both the corporate and shareholder levels. The income tax rate would also be flat 21%.

Also, if the business is not a C corporation, the tax rate would depend on the taxable income and the filing status.

Know The Entity Type

There are several business entity types you need to know about. There are C corp, partnership, sole prop, etc. But for the purpose of finding out how much tax the small business actually owes, there’s only C corporations, and everything else.

If you are not sure what the entity type is, just ask the CPA. He would be able to guide you properly on this. Moreover, if you have a small business with no accountant and you haven’t thought about entity type, there are chances the government would classify you as a sole proprietor.

C corporations are the only business type that pays corporate income taxes. So, if your business is not a C corp, it known as a flow-through entity since profits and losses flow through your business to shareholders and owners, who pay the taxes at the individual rate.

How Can You Figure Out The Tax Rate If You Are A C Corp?

The Tax Cuts and Jobs Act really simplified tax services such as calculations for C corporations. It has replaced the graduated corporate tax rate schedule that includes eight various tax rate brackets with a flat 21% tax rate.

In simple words, if you are the owner of a C corporation, irrespective of the taxable income your business has, the income tax rate would be 21%.

Double Taxation For C Corporations

The way this tax system has been structured, the C corporations usually get taxed twice; at the shareholder level when profits get distributed to owners as dividends and at the corporate level.

One way for corporations to skip this double taxation is to incorporate as an S corporation instead of a C corporation. Now, S corporations are usually flow-through entities so income doesn’t get taxed at the corporate level.

But there are some drawbacks to choosing S corporation status that might outweigh the tax savings. It is better to consult with your CPA on this one.

How Can You Figure Out The Tax Rate If Not A C Corp?

If your business is not the C corporation type, it means this is a flow-through entity. Due to this, you would be paying taxes yourself, instead of the business paying them.

The tax rate would depend on the amount of the business’s taxable income as well as your tax filing status.

Making Estimated Tax Payments

Many business owners actually think that their income tax payment deadline is on Tax Day, which falls in mid-April. But federal income taxes need to be paid as incurred.

It means that most of the small businesses need to make payments throughout the year depending on the estimate of their total taxable income at the year-end.

Finding out how much your small business owed in taxes is actually the first step. Once you have got it all figured, you would need to pay the taxes. If you have any confusion or question, hiring a CPA would be the best option.

Contact Us Today:

Locations: