When considered from a cash flow point of view, the Employee Retention Credit (ERC) feels like a great advantage for many businesses. But when tax season arrives, you may start wondering: Is the Employee Retention Credit Taxable Income? Technically, it is not. Still, the credit impacts payroll deductions, which then changes your taxable profits.

How Does ERC Affect Tax Returns

ERC can affect your tax return in different ways. The impact depends on:

- How much ERC you claimed.

- How many payroll expense deductions you took during the year.

- What type of business entity you run.

So, even if ERC is not taxable income directly, it still matters because it changes how you report your deductions.

Is ERC Taxable Income

You may ask again, is the employee retention credit taxable income? The answer is no. But ERC reduces the payroll expense deduction you can take. That means your taxable income may increase, even though ERC itself is not counted as income. Working with a reliable tax service can help you understand these rules and manage the impact on your business finances.

This rule comes from IRC Section 280C. It says when you take certain credits, like ERC or R&D credits, you need to reduce your deductible expenses. This stops businesses from claiming both a tax deduction and a tax credit for the same wages.

By reducing your payroll deduction, ERC affects your net taxable income. So, while ERC is not directly listed as income, the credit does change your tax position.

Many business owners also ask, are ERC tax credits taxable? The IRS has made it clear that ERC itself is not taxable, but your payroll deductions must be reduced by the same amount. This rule is what increases your taxable profits indirectly, making professional tax service guidance even more valuable.

Reporting ERC on a Tax Return

Reporting ERC depends on the type of business you own. Corporations, partnerships, estates, and trusts all have different forms. For example, S-corporations report ERC through Form 1120-S. Partnerships use Form 1065. In both cases, the ERC credit also shows up on Schedule K-1.

In addition, some businesses file Form 5884-A to claim ERC if they were affected by a qualified disaster.

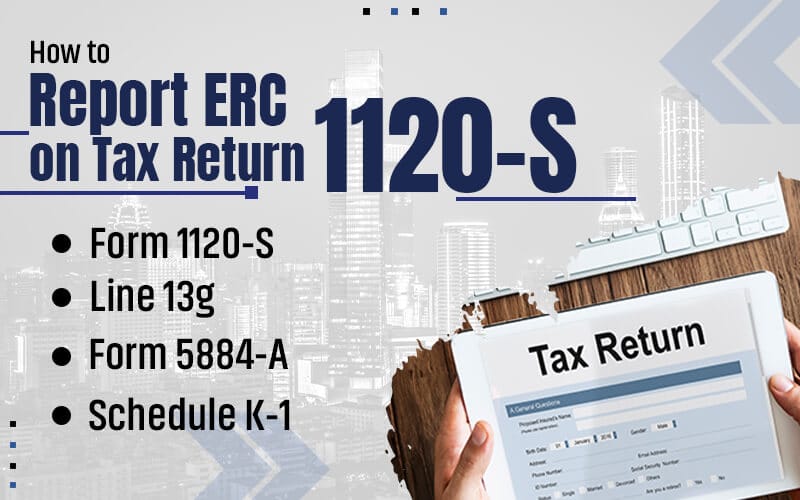

How to Report ERC on Tax Return 1120-S

If you run an S-corporation, ERC reporting happens through Form 1120-S. This is the main form where the business reports income, losses, credits, and deductions. Here is how ERC fits in:

1) Form 1120-S

This form reports all business financials to the IRS. For most companies, it is due March 15 of the following year.

2) Line 13g

ERC belongs under “Other Credits.” This section includes credits that do not have their own category, such as work opportunity credits or Social Security tax credits. ERC is reported here and must also be linked with Form 5884.

3) Form 5884-A

This form is used if ERC relates to a qualified disaster. Eligible businesses can claim 40% of up to $6,000 wages per employee. That equals a maximum credit of $2,400 per employee.

4) Schedule K-1

Every shareholder in an S-corp gets a K-1. It shows their share of the business’s income, deductions, and credits. ERC amounts are passed through to each shareholder on this form.

Reporting ERC on Form 1065 (Schedule K-1 for Partnerships)

For partnerships, ERC is reported on Form 1065. Each partner gets a Schedule K-1 showing their share of income and credits. Here is the breakdown:

- Step 1: Complete Form 1065 with profits, losses, and deductions.

- Step 2: Go to Box 15, “Credits,” on Schedule K-1. Report ERC here.

- Step 3: Make sure payroll deductions are reduced by the ERC amount so credits are not double counted.

For example, if a partnership earned $500,000 and two partners share equally, each partner would show $250,000 income on their K-1, adjusted by the ERC claimed.

Must Read: How Much Does a Bookkeeper Cost? An Overview of Bookkeeping Pay Rates in 2025

Closing Statements

So, is the employee retention credit taxable income? No. ERC is not direct income, but it affects your payroll deductions. This is why some people ask, if the erc tax credit taxable rule applies. In reality, ERC is refundable and not taxable income, but it changes your deductions and final tax results.

For S-corporations, you will report ERC on Form 1120-S, Line 13g, and Schedule K-1. For partnerships, you will use Form 1065 and Box 15 of Schedule K-1. Filing Form 5884-A may also apply if ERC is linked to a disaster.

Accurate reporting helps your business avoid errors and stay compliant. Working with the right CPA makes this process smooth and worry-free. For expert guidance on ERC and tax reporting, contact Jarrar CPA today.3

FAQs

Can you amend a prior year’s return to claim the ERC?

Yes. You can file Form 941-X to claim ERC retroactively. Generally, you have up to three years to amend payroll tax filings.

Can you claim both PPP and ERC?

Yes, you can. But the same wages cannot be used for both PPP loan forgiveness and ERC.

What payroll expenses are eligible for ERC?

Eligible payroll expenses include wages paid during qualifying quarters and employer-paid health plan costs. They cannot overlap with PPP wages or other credits.

Does receiving ERC delay your tax refund?

Not directly. ERC itself is separate from your income tax refund. Refund timing depends on IRS processing.

Do sole proprietors qualify for ERC?

No. Sole proprietors cannot claim ERC for their own income. However, they can claim it for wages paid to employees, if they have any.