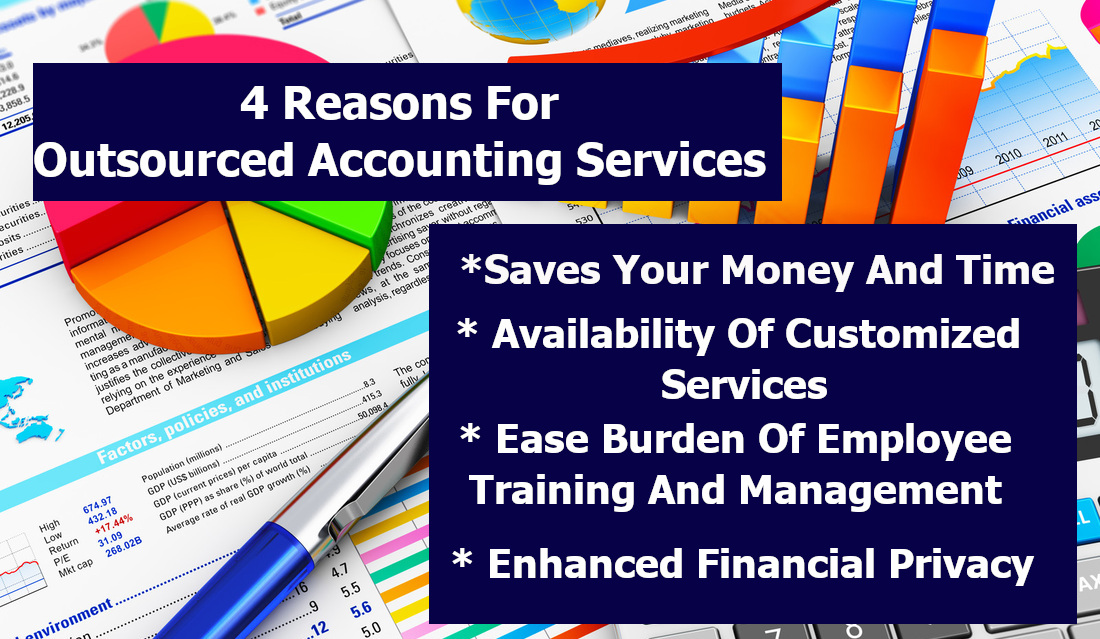

Top 4 Reasons Why Your Small Business Needs Outsourced Accounting Services

On the first day of your business, the chances are that other than the expense receipts, you would not have enough accounting demands. But once your company starts growing and becomes busier, you would know accounting assistance. Just like most of the business owners, you would probably be spending more time managing the finances apart from concentrating on the other aspects of the business.

This is when you need to avail small business accounting services to streamline and keep your expenses, etc in check. In other words, outsourcing the accounting services definitely turns out to be in your favor, undoubtedly. Here you will find out what outsourced accounting service professionals can do for you and your small business.

Partnering With Outsourced Accounting Services

Saves Your Money And Time

As the business owner, your time is extremely crucial. When you find out how much you can earn for the hours you spend itemizing expenses, sending invoices, paying bills, you would find out that you are working at a pretty expensive rate. Now, this wouldn’t happen when you outsource the accounting services. This frees up your time, thereby allowing you to focus on what you can do best, i.e. running the business.

Availability Of Customized Services

Most of the service providers offer you customized services. When you choose one, it would allow you to pay for the services that your small business actually needs. In other words, it allows you to add more value to your business. Moreover, often customized services are designed in a way that seems to be tailor-made for your business alone. This helps you stay organized, which otherwise wouldn’t have been possible.

Ease Burden Of Employee Training And Management

In the case of small-sized businesses, the responsibility of managing and training employees belongs to you since you are the business owner. Now, training and managing accounting employees can also become quite challenging. Now, the constant change to compliance rules, technology updates make it quite difficult to find, supervise and train employees. However, when you outsource small business accounting services the professionals are well-trained thereby relieving you from the hassle altogether.

Enhanced Financial Privacy

When you actually hire an individual for handling the bookkeeping and accounting tasks, you actually risk your business’s financial privacy. However, there is no guarantee the employee would remain with your company or they would refrain from discussion about business. But an outsourced provider ensures a proper layer of confidentiality the in-house employee can’t. Due to this reason, you must hire an outsourced small business accounting service.

Finally, hiring small business accountants is one of the ideal ways to keep your business running. They are experts with proper knowledge and expertise that you need.

Contact Us Today:

Locations:

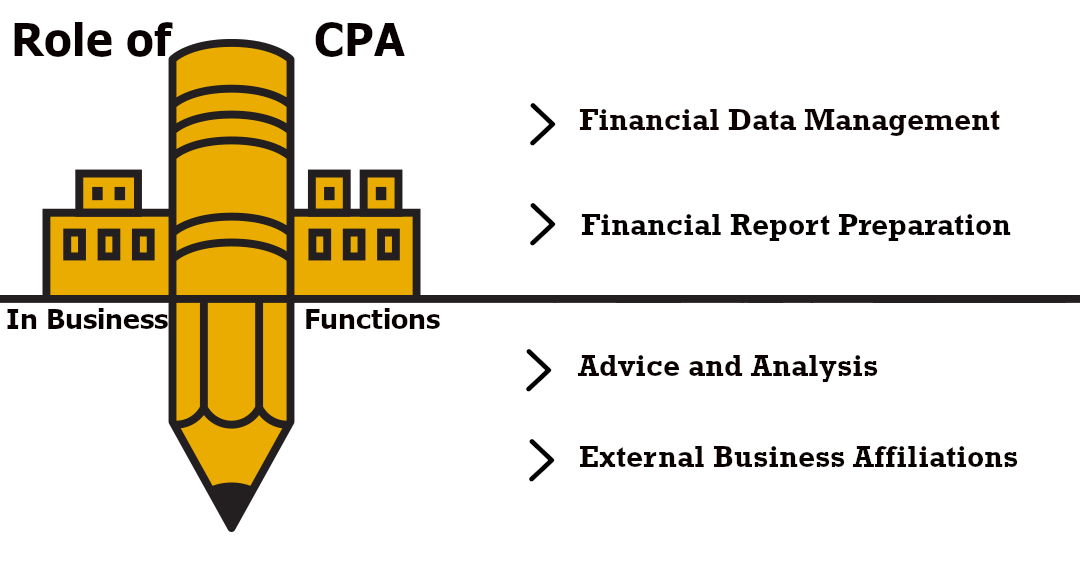

What Role Does A CPA Century City Play In Business Functions?

Accounting is the pulse of the business, whether it’s big or small and there is nothing like CPA who can help you. The expenses, cash flow, income and budgeting are all needed functions of every company, regardless of industry and its size.

Multinational corporations, sole proprietorships as well as businesses must know where they actually stand financially. Now, you must know that cash flow is an integral part of the business. Also, for success, proper tools to tracking the financial health needs to be in place.

The CPA Century City can offer you all the assistance that you need regardless of the business size. Whether it’s a startup or a reputed company working since long, everyone needs an experienced and qualified CPA to manage the accounting tasks well.

Assistance From CPA Century City

Middle or large sized businesses might utilize the CPA as a financial interpreter or as an advisor, who might be able to present the company’s financial data to the others within as well as outside of the company. Apart from this, the CPAs also deal with third party agents such as customers, vendors and more.

Ways In Which CPA Helps

If you are still wondering whether or not you must hire a CPA, you need to think again. The professionals help you in every aspect so that you can concentrate on taking your business to a new height.

Financial data management– The accounting structure of your company is an important component for business operations. One of the main roles of the CPA Century City is to collect and maintain the financial data, as it related to the firm or company. Also, the professional ensures the financial records are well maintained in compliance with the law. They understand how important it is to maintain the financial information in a pristine system since it is the main component for managing business.

Advice and analysis– the CPAs also play the role of an analyst and perform some kind of analysis using proper financial data that’s used to help in the bigger business decisions. Right from deciding which type of supplies you need to order, bill payment as well as payroll, the CPAs do it all and with precision. That’s not all, they also handle intricate several financial details on a regular basis. Advising you on business operations is another area where they prove their expertise. The CPA Century City also analyze the financial data to solve several irregularities and discrepancies that might arise.

Overall, the CPAs help your business in several ways such financial report preparation, external business affiliations and more.

Contact Us Today:

Locations:

Why Hiring A Bookkeeping Service Is Essential

Bookkeeping services are an important part of running any small sized business, but it might happen that you been doing all the bookkeeping by yourself. Now, there are many disadvantages of doing the bookkeeping all by yourself. For instance, it might seem that you might be able to cut down the cost, however, it actually costs you more in the long run. Without expertise and proper knowledge, you would definitely not be able to do it yourself. This is exactly why you need bookkeeping services by experts.

Interestingly, there are signs that indicate when you must avail bookkeeping services for your business or why hire a bookkeeping services is essential. However, there’s one thing for sure, irrespective of the business size, availing bookkeeping services is essential. Here are some of the easy ways to spot when you need a bookkeeper for your business. After all, it is best to become jack of all trades at times.

You have little or no time for the business

You might have noticed that you are spending a lot of time doing the books. In fact, to that extent that it is actually eating up your time that you might have kept for creating new business leads or for planning. Since, you are always on the go, there is a tendency that you cannot keep up with the collection. This could be a disadvantage for you since it might affect the gross margin. Now, this could be a clear sign that you need to hire bookkeeping services Santa Monica.

Receipts are not be found anywhere

We know that you might be trying your best to keep up all the records in good condition. But you must accept that it can never be as perfect as you think it might be. Time is extremely valuable, therefore, keeping up with the little details is impossible. Your financials might be all over the place. The reason why you have started the whole thing is for running the business and definitely not to be a bookkeeper. There are tasks that are better left for the professionals. So, why take changes? Hiring a bookkeeper is what you need to do.

You lack prior experience

If you are not the type who prefers to keep it all organized, the paperwork is not at all for you. Bookkeeping services entails a lot of responsibility including paying proper attention to every detail. Now, accountants have higher rates than the bookkeepers, so even if the task is same you often end up hiring an accountant over the bookkeeper. What you need to do is understand who performs which task better and hire the right professional accordingly.

Also Read: 401k Retirement Plan Guidelines: Everything You Need To Know

You are not updated on tax laws

You are no longer sure as to how much your company actually spends on daily basis since the work has caught up with you. However, knowing how much the company spends gain a lot of importance. Tax compliance is important for running a business and by availing bookkeeping services Santa Monica you can actually stay updated without you having to do much.

Contact Us

Santa Monica Address:

Projected to Owe Taxes Coming Year – What Should Your Tax Planning Be?

With the onset of a new year, you might wonder about the tax plans for the next year and how you must prepare for the tax season. Now, with the constant tax reforms coming up, it is essential to hire experts who can assist you in tax planning Beverly Hills. Tax reforms might also mean you owe money next year. What would do you to prevent that? Well, this is when the tax services professionals actually come to your assistance to help you ease the tension.

It might also happen that you miscalculated the numbers and you owe money. However, there’s nothing to panic as you have tax planning experts by your side to help you out of this situation.

Here are some of the tax planning tips you must follow

Contribute Towards Retirement

Not only are you building up the retirement stash, but if you are doing it, you are also contributing to traditional IRA thereby lowering the taxable income now. You can find out the contribution limit for 401(k) For your IRA. However, the tax accountant would always be at your service. By contributing to retirement plans you can easily save on your taxes.

Donation For Charity

The holiday time is great to clean your home and to give those in need. You can help others while reaping the benefits. Ensure you consider a donation to charity organizations as part of your tax planning Beverly Hills. This would help you get benefits of tax deductions for non-cash and monetary donations that you have donated to a recognized charitable organization if you can itemize the tax deductions.

However, if you volunteer at any proper charitable organization, do not forget to deduct the mileage that’s driven for the charitable services. When you choose a proper tax accountant, he would track the yearly donation and the mileage for volunteering.

Don’t forget to count on the taxes by donating. However, even if you donate by paying through your credit card, you don’t need to pay it off to get a tax deduction.

Consider Things You Do Year Long

Do not forget that things you actually do in your daily life when thinking tax planning Beverly Hills would amount to tax deductions or credit that might improve the tax picture. Also, don’t forget to start gathering important receipts for the tax-deductible expense such as college, medical, childcare and more so that you can include it in the taxes.

Know Your Stand

When you move to the end of the year, you must find out where you exactly stand, especially with your taxes and the finances. This would help you make good monetary moves. However, if you haven’t found out yet, you must go ahead and review the numbers carefully.

By hiring tax professionals for tax planning Beverly Hills, you would be able to find out exactly your financial status and make the right tax saving moves.

Start Saving Early

One of the other things that you must do is start saving early. This would give you time to start planning how to pay and save. If saving becomes difficult for you, start up with a money challenge.

Beverly Hills Address:

What tax penalties can you avoid with top-notch tax services?

As a common proverb, nothing is permanent except death and taxes. Well, even if everyone knows about it, a surprising list of people fail to file the income tax return. Are you one of them who thinks you would be able to evade it? It is time to reconsider your plans. However, why worry when you have experts helping you with the tax services Beverly Hills.

Even if you have not been able to do pay the tax, you must file a return. It is mainly because if you don’t do it, this would give rise to numerous domino effect of consequences. No matter how many individuals tell you that it’s no big deal and the IRS have bigger things to look on, remember the IRS have a job to do. Even if no legal action would be taken against you, if you fail to file the return it would work against you.

By hiring the expert professionals, you can make the most of it and not face negative consequences.

Filing tax return is mandatory

When you are confused about whether to file the return or not, it is always better to leave it in the hands of the experts. You can avail tax services Beverly Hills and ensure that you file the return at the right time to escape dire consequences later

There are instances when you don’t need to file the tax return. For instance, if your income is less than the standard deduction and you don’t owe self-employment taxes, then you don’t have to file any tax return. Even if you don’t have the money to pay the tax, then too you need to send a tax return rather than skipping it completely. Here’s why;

The IRS imposes a fee for not paying the tax and also imposes a separate fee for not filing it. Also, the fee gets charged every month. You sure don’t want to face this hassle, right? This is one of the reasons why hiring tax experts would be beneficial. In fact, whatever you pay or you don’t, you would be able to save big by submitting the necessary paperwork.

You must also consider the facts what IRS does or how they take action when you don’t pay taxes. It involves preparing a substitute return that would be completed without consideration of tax advantages. The best way to find about this is by availing tax services Beverly Hills. The tax experts have all the necessary knowledge that would help you in the long run.

The IRS is also limited to the statute of limitations, which gives you three years time from the date you have filed to perform the audit. This time period starts when you file the return. So, the sooner you get the paperwork done, the chances of IRS audit reduces. The tax professionals can actually help you in it.

What happens if you file the return without submitting the money you owe?

Once the IRS processes the return that doesn’t have a payment or discover that you have failed to file and pay the tax, they would issue a Notice of Tax Due and would demand a payment related to how much you owe in the tax, penalties and interest. However, if you don’t have enough funds for the payment, it is better to avail assistance from tax services Beverly Hills to help you resolve it.

Options for resolving include;

• Allowing a temporary delay

• Setting up an installment agreement

• Settling through an Offer in Compromise

It is better to avail the tax assistance before you land yourself in such tax return issue.

Beverly Hills Address:

Should I really Hire Accountant For Managing My Business?

You might think that bookkeeping and accounting are actually necessary evil more so to satisfy government reporting that mostly includes taxes.

But the fact is, it is not just about taking assistance to keep your tax records clean, but more about making informed decisions. Here, you would know about the benefits of hiring an accountant Beverly Hills that actually turns out to be a boon than a bane.

If you ask someone or yourself whether hiring an accountant is needed, you might think of once you would do it all by yourself. But have you thought how much you need to spend on that task and then looking after your business? Well, to avoid it all, the best solution is hiring an accounting professional who excels in it.

Here are some of the things you should consider before thinking whether you actually need to hire an accountant to manage your business.

Do Consider Your Business Tax Affair Really Easy?

You can surely sit and debate on this question about what simple actually means to you. If you are self-employed and the business consists of raising invoices and the expenses are direct debits, then you need to hire an accountant to keep things sorted.

Next, if your clients make advance payments or you have to buy large pieces of equipment such as van you might need a loan, this is another instance when an accountant Beverly Hills comes into the picture. If you know people managing their own accounts, just find out how many mistakes they make. In simple words, somethings are better left in the hands of the experts- accountants. If you want to avoid costly mistakes, you can avoid it by hiring an accountant.

Do You Own a Limited Company?

If you own a limited company, the best thing would be to hire an accountant right away. Moreover, in some cases, you can also ask the accountant Beverly Hills if forming a Limited Company would be right for the business.

Hiring an accounting expert has many benefits since managing funds of a Limited Company isn’t easy. On the other hand, if you try to do it yourself you might land up making numerous mistakes that might land you and the business in trouble. Why take such risks, when hiring an expert accountant is what it takes to keep your business running smoothly?

Do You Feel Confident Managing The Accounts?

This is one of the primary questions you must ask yourself. Simply ask yourself do you feel confident about managing accounts? Does the thought of doing or managing your tax returns make you nervous? There is no better reason for hiring an accountant.

What you need to know is that if you avail the services of accountant Beverly Hills, you are not bound to it for life. You must choose the best and friendly accountant. Also, be honest with the professionals so that you can learn from them some of these accounting processes.

Can You Afford Hiring An Accountant For The Business?

You must know that hiring an experienced accountant wouldn’t be too costly. However, it is always better to go for full-time professionals and not freelancers. Full-time accountants would give you best services since they are more experienced. You can shop around carefully or hire accountants through referrals. Don’t forget to ask what other services you would get along with accounting.

What To Do If You Are Unsure About Hiring An Accountant?

This is not very simple to answer.

If you hire an accountant then you can risk paying the money for the services you aren’t confident enough of doing. On the other hand, if you try to do it yourself and not hire an accountant, you might have to pay a fine, overpay some tax, etc.

The best thing would be to spare some time and interact with a few of the accountants. This would help you find out who can actually help you in managing the business accounts. Choose the accountant you feel comfortable with since your business’s success depends a lot on the professional.

Now, once you feel ready you can go ahead and hire the right accountant.

Contact Us Today:

Beverly Hills Address:

Essential Tax Strategies for High Net Worth Earners

No high-income earner wants to pay a heavy tax. In fact, for them, the tax is a matter they prefer to discuss in a hushed tone. Moreover, it appears as if their trying to save money is like cheating the government, which is not the way it is.

For the most part, the tax incentives usually come from the high-income earning individuals. Due to this most of the wealthy people take the assistance of tax filing services from renowned experts. In some of the cases, the taxpayers don’t actually qualify for the tax benefits. There are numerous Americans who earn higher, but fall in the middle-class section or those who have many expenses to cover.

Tax planning is crucial since it helps achieve tax efficiency. It ensures you pay the least amount of tax in the given situation. This type of practice is present for all taxpayers having annual earnings of $40,000 and above. But there are some tax strategies that every high come earners need to follow. This is where a little analysis, proper strategy and your creativity comes into action.

The Current Tax System At A Glance

The present tax system usually taxes the individuals based on the income brackets. This is how it works, the higher your income, the higher the tax you need to pay. The government implements a credit and deduction system that has been designed to limit your tax amount.

You would see that only 1 percent of the taxpayers pay just 40 percent of the federal tax income. Since most individuals lack the skill and knowledge about tax filing, they go ahead and hire tax accountant Los Angeles. Whether you have inherited your family business or you own a business, there are some tax strategies you need to follow to save thousands more on the taxes.

Consider Retirement Accounts

You definitely need to have a retirement plan, after all you won’t be going on working till your death. However, if you really want a comfortable retirement plan, investing in the right type of retirement account is one of the ideal strategies for high income earners.

About 401 (K) Plans

If you are working for a company having 401(k), ensure you make the most of it. This is mainly because the 401(k) contributions consist of pre-tax dollars. This usually gets deducted from your salary or paycheck and gets deposited in the 401(K) account. It is a great plan if you are considering a low tax rate during retirements. If you have an accountant, know about this when discussing tax filing services.

Individual Retirement Account (IRA)

The traditional IRAs don’t actually offer you any tax-deductible benefits if you have a Modified Adjusted Gross Income of $72,000 and the earnings get tax-deferred. However, the IRAs allow you to contribute after tax dollars while the earnings get tax-free. You must keep in mind that if you have pre-tax IRAs, the IRS would usually impose a tax on the accounts during the conversion.

If you are self-employed and you have employees, try setting up a Simple IRA. It is less costly for the business and you need to make a low contribution annually.

Crucial Factors To Consider During Tax Planning

Before you take the assistance of a skilled tax accountant Los Angeles, you need to make some considerations.

Paying tax later is better than paying it now- It is known as deferring tax. If it can be deferred for a later time, it is better for you as a taxpayer. Tax deferring provides you flexibility and if legally possible, you can defer it.

Don’t spend a dollar to save 30 cents- It is a rule that you must follow if you are a business owner, but it applies to all taxpayers. Usually at the year end, the taxpayers always try their best to reduce the taxable incomes by overspending.

A strategy like this actually makes sense if you are purchasing items you wanted always, irrespective of the tax plan. You definitely don’t need to spend money haphazardly just to save a few cents on your tax.

Contact Us Today:

Locations:

Watch Out For The Red Flags When Hiring An Accountant

There is no doubt that consistency is crucial to tackling money laundering. In fact, criminals have often used the services of the accountants to launder illicit funds. But you often underestimate the extent of the threat to the company and individuals. The wrongdoers often develop businesses that might appear legitimate at the first glance. Often accountant in Beverly Hills misguide you, so choosing the right professional is important.

Interestingly, nothing escapes the eyes of the entrepreneurs. The professionals are well-trained and highly skilled to spot any malice right away. When hiring an accountant in Beverly Hills, there are some red flags you must always watch out for to help you pick the honest professional.

Here are the red flags that your accountant is not working in your best interest.

Making False Write Offs –

Did your accountant ask you to take a write off such as a charitable contribution even if you didn’t make one? Well, this is the first sign that he is leading you to a big trouble. In fact, he might do the same with our clients and if the IRS investigates him for filing bad returns, then all his clients would be audited, including you. If he is asking you to make false write-offs, skip him.

Record Include Short Contracts –

Does the accountant Beverly Hills has a track record of short contracts for two or three months. Now, this should be an instant red flag. Remember no business or individual would let off an accountant if he is good at his work. No one wants to wastes time searching for another accountant. However, if he has worked for short-terms, then he is probably not the right person.

No Signature As Paid Preparer –

When you have an accountant the professional needs to sign as a paid preparer. Did you see the sign missing from the tax return document? Check if he has signed. However, if he hasn’t signed, he might be reporting questionable items on your return. Do you want to take that risk? Sure not, right? Well, then you must take this red flag seriously. Remember, all accountants must sign the return they have prepared.

Lying To Get Tax-Breaks –

While all accountants do everything, they can to find deductions and other tax breaks for which you actually qualify, you must watch out for those to embellish flat-out lies to get you a tax-break. Ultimately, this would come back to haunt you and the last thing you would want is to get audited by IRS. No honest accountant in Beverly Hills would ever put you in such a situation. So, choose carefully.

Finding an honest accountant is not difficult. But you need to spot the red flags so as to find the right professional you need. Moreover, don’t get carried away by everything an accountant promises.

Beverly Hills Address:

How Do the Best Accountants Survive the Busy Season?

Accountants share stories of working 80 hours a week or gaining 10 pounds from the stress. You would never want to hire any accountant who’s too busy to pay attention to your need. The best accountant considers this time of the year for achievements and growth for the firm. Infact, he survives the season by managing the stress and tension. Here are some smart ways an accountant in Culver City survives the busy season.

Plan Early Requirements

It is difficult to finish the work without proper prerequisite direction or documentations. This can be a burden for many accountants. There can be instances when you won’t provide the materials they need. They ask from you even if you forget. Moreover, the best accountant in Culver City doesn’t spend late nights at work. They talk to you early to avoid all hassles later. It involves making a checklist along with deadlines to meet. They make it easy for you to comply so you face no issues.

Thorough Organization

The busy accountants don’t want is spend time dealing with reminder mails and scheduling. The right accountant Culver City finds tools for organizing the calendar. It allows them to access anything when needed. This saves them from calendar overload and huge mails. The most experienced accountants work to centralize the calendar to help you better. Creating proper inbox rules helps funnel important mails and keeps them sorted.

Sticks to Schedule

Good accountants don’t plan things for the sake of it. They also make it a gospel they follow. The main cause of stress is a hectic work schedule. But the accountants plan up everything in a concise manner and follow it. Even if you miss to turn up for appointments they drop a mail or text to ensure you do. In other words, they respect time both yours and themselves. If they are jam packed they make it a point to inform you the same.

Also Read: Top 5 Factors to Consider to Find the Best-Fitted Accountant for Your Business

Takes Proper Breaks

No person can go on working without taking any breaks. When it comes to accountants, the work becomes streamlined. In such a case, breaks become a necessity. Good accountants understand this well and take breaks to return with zeal. It depends on the accountants how they take it. It is either a long vacation in a year or a few short trips. No matter what, it helps them combat the stressful work season with ease. They embrace the opportunities to embrace opportunities and change.

Work Delegation

An experienced accountant in Culver City deals with the busy season by delegation. It means they hire other accountants to help them. Delegation helps ease the burden off their shoulder. At the same point, it keeps you happy since you don’t need to wait to get a chance to talk to him. He or someone from his team is available for your help.

Contact Us Today:

How to Close Your Year-End Book Successfully? Top 5 Tips

In every financial yearend, we are often asked a number of queries from our clients. And, most of them are worried about how to close their year-end book. Well, this is true that closing the year-end book successfully is a daunting task for the companies until and unless they take help from professional accountant in Santa Monica. If you want to do it yourself, you can follow a few tips. Below are discussed top 5 tips that you can follow to close your year-end book.

1. Make a checklist:

Based on the needs and the requirements, every company should keep a monthly, quarterly, weekly or annual checklist. The dedicated person has to make the schedules entries to complete the checklist in an error-free way. Completing work in a timely manner would help you to keep your closing process consistent and accurate.

2. Reconcile your bank accounts:

In order to investigate whether there is an outstanding check for over 2 to 4 weeks, you should reconcile your bank account. You can capture your cash activity accurately by reconciling your bank account in a proper way. If you reconcile your account on a regular basis, you will be able to investigate if there is any difference in your company account.

3. Conduct an inventory count:

The next important thing that you need to follow is to conduct the inventory count if you have any. The professional accountant Santa Monica can help you to document the counting process and keep the records of the count.

4. Update your cap table:

If you are among those, who keep their books on an accrual basis and adhere to the US GAAP, you should book non-cash entries and update your book. We find maximum errors are non-cash related, like, stock option expense, stock compensation, discounted debt etc. Don’t forget to include them in your checklist.

5. Analytics:

The easiest way to find errors before they occur is analytics. Look at your income statement and balance sheet against what you expect and investigate if there are any anomalies at a more granular level. By comparing results to prior period numbers, you can measure your company performance in comparison to previous benchmarks.

By following the above-discussed tips, you can close your year-end book successfully in an error-free way. However, the accountant services in Santa Monica can help you to close your year-end book in the most efficient way possible.