Should Your AEC Firm Use QuickBooks Bookkeeping Services?

You may think that the AEC (Architecture, Engineering, and Construction) industry has so much more to do than choosing bookkeeping services. Still, efficient finance management is critical to managing accurate budgets and project timelines to ensure overall business health.

Bookkeeping is crucial, irrespective of the industry, and QuickBooks is a popular and beneficial tool for handling these tasks. It is a comprehensive accounting software with widespread global acceptance across sectors. But is it the right choice for your AEC firm? This blog post delves into the advantages and considerations of using QuickBooks bookkeeping services for your firm.

What is QuickBooks, and What are its Benefits?

QuickBooks is an accounting software package developed by Intuit. It has several features that help businesses manage their finances, including:

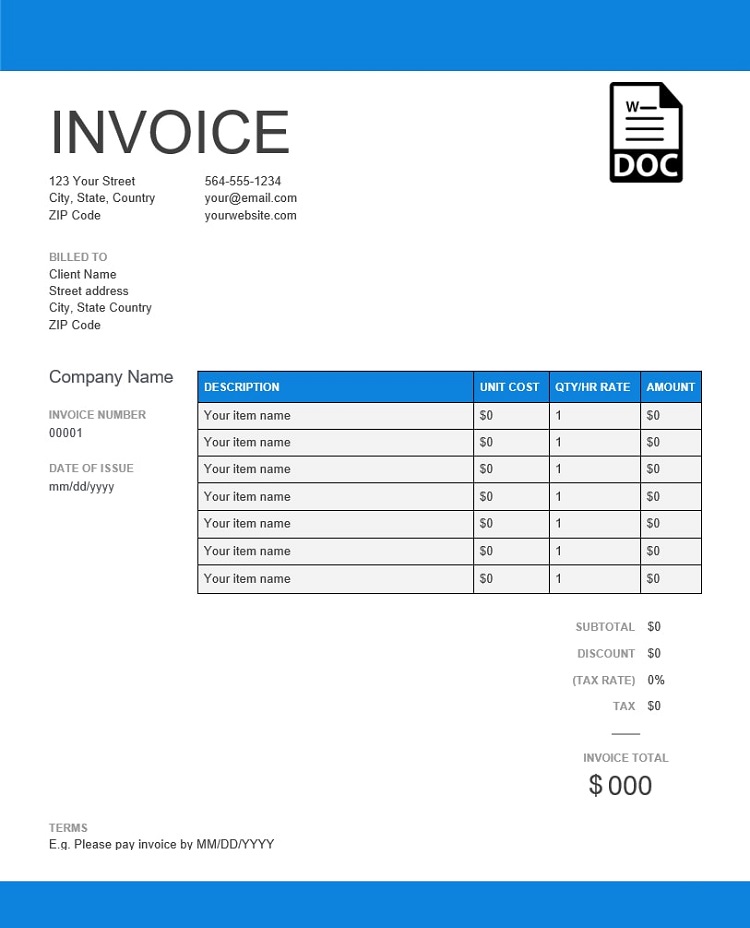

- Invoicing and Billing: You can create and send professional invoices and track payments.

- Expense Tracking: You can track expenses, categorizing them for in-depth financial insight.

- Payroll Management: It lets you handle payroll processing, such as tax calculations and direct deposits.

- Financial Reporting: It generates elaborate financial reports to assist you in making decisions.

- Tax Preparation: It simplifies tax preparation using inbuilt tools and integrations.

Benefits of QuickBooks for AEC Firms

-

Project-Based Accounting

AEC firms generally work on multiple projects simultaneously, each with its timeline, budget, and financial requirements. QuickBooks helps you set up and manage projects, expenses, and resources separately, a feature beneficial for project-based accounting, as it enables you to monitor each project’s financial performance and ensures accurate budgeting and forecasting.

-

Time Tracking and Payroll Integration

With QuickBooks, you get powerful tracking and payroll integration abilities, features AEC firms benefit from. Contractors and employees can log their work hours directly into the system, and this data can help process payroll efficiently. Accurate time tracking helps with precise billing, keeping clients happy, and ensuring efficient labor cost management.

-

Expense Management

Expense management is crucial for maintaining profitability in the AEC industry. QuickBooks enables you to track expenses in real time. You can categorize them and link them to specific projects. With expense management, you get a clear picture of where you put your money and how you can save costs.

-

Financial Reporting and Analysis

Get a range of financial reports like balance sheets, cash flow, and profit and loss statements with QuickBooks. You can customize these reports to address the specific needs of your AEC firm, and they can provide valuable insights into your financial well-being. Regular financial analysis helps make informed decisions and boosts overall financial management.

-

Scalability

QuickBooks is perfect for businesses of all sizes, whether you own a small startup or a large enterprise. As your AEC firm grows, the software scales, offering additional features and integrations that support your expanding needs.

Considerations Before Choosing QuickBooks Bookkeeping Services

-

Project Complexity

Although you get robust project management features with QuickBooks, complex projects with complicated financial requirements may require more specialized software. So, before choosing the software, assess your project complexity to ensure QuickBooks can handle your specific needs.

-

Integration with Other Tools

AEC firms generally use specialized software for project management, design, and collaboration. Can QuickBooks integrate seamlessly with your existing tools to prevent data silos and streamline workflows?

-

Training and Support

Incorporating a new application necessitates training and support. Ensure your team is ready to learn and use QuickBooks effectively. You can get various resources like tutorials and customer support from Intuit to help with this transition.

-

Cost

While you get different pricing plans with QuickBooks, evaluate your overall costs, including subscription fees, payroll services, and any extra features you might need. Compare them with other accounting software to determine what’s best and ensure value for money.

-

Seek Professional Bookkeeping Services

When in doubt, look for professional quickbook bookkeeping services. You can get experienced professionals capable of providing you with quality services. They know the best solutions to address your specific needs with ease and streamline your workflows.

The Takeaway

QuickBooks offers many benefits for AEC firms, including expense management, project-based accounting, financial reporting, time tracking, and scalability. However, consider the complexity of your projects, training needs, costs, and integration with existing tools before deciding. A careful evaluation of these factors can help determine whether this software is the right choice for your AEC firm so you can manage your finances more effectively and boost business success.

5 Common Business Bookkeeping Mistakes & How To Avoid This

Worried about messing up your books? Don’t sweat it. Almost all entrepreneur makes bookkeeping blunders while they are still learning. Thankfully, you can fix bookkeeping errors if you catch these early.

Here’s a list of some common bookkeeping mistakes you can find, along with the best advice on how you can avoid these once and for all.

Schedule A Consultation Today!

Guessing The Way Through

Entrepreneurs tend to do the guesswork for bookkeeping when they are not sure what they are doing.

The problem is guesswork increases over time. It potentially leaves every year’s books that need fixing at the tax time.

Some examples include:

- Not categorizing expenses correctly

- Overlooking tax deduction

Don’t stress if any of this sounds familiar. We are going to explain how you can avoid the bookkeeping mistakes below. If you are new to bookkeeping, brush up on the fundamentals or hire expert bookkeeper Los Angeles who can help you.

It makes sense to outsource the task to a pro since they know how to go about it and assist you in every step.

Wasting More Time Than You Need

If your bookkeeping isn’t for your business, you will spend way more time doing books than you should. However, you can avoid this situation by setting up a chart of accounts from day one.

Schedule A Consultation Today!

Putting It Off Till You Are Guilty

Nobody enjoys bookkeeping. But if you wait until the shoebox is overflowing with receipts, and your guilt drives you to a bookkeeping binge, there are consequences.

- You will struggle to remember what the receipts and transactions were for.

- Bank reconciliation would be a nightmare.

- You won’t have time to fix errors before turning them into big problems.

If your bookkeeping needs are insane, it is best to hire a bookkeeper with experience who can help to avoid

bookkeeping mistakes.

Related Article: Importance of Accounting And Bookkeeping Services For Small Businesses

Mixing Business And Personal Spending

You take a client for dinner but forget your business credit card. Not to worry, you can pay for it with your card. Right?

It may be easy to pay for a business expense with personal funds. But commingling the finances make bookkeeping as well as taxes confusing. It can remove a layer of legal protection if the business gets or audited.

Here are some tips to help you keep everything sorted:

- Manage business finances in their business account

- Get a dedicated business credit card

- Put a sticker on the business credit card to identify it

Of course, if you accidentally pay, there is no harm. You can reimburse the business account purchase or record the purchase as an owner’s draw.

But why bother when you can avoid this in the first place?

Not Reading Financial Statements

Financial statements are a direct window to your business’ financial performance. If you don’t read these, you miss- out on the big-time opportunities. It can help in generating reviews and avoiding financial disasters.

Finally, you can easily avoid all bookkeeping mistakes. But you can avoid it by hiring experienced professionals.

Contact Us Today:

Locations:

How Much Do Accounting And Bookkeeping Services Cost For Small Businesses?

If you own a small business, managing the finances isn’t an expense you want as it will drain the bank account. Now, it can be hard to find if these accounting costs are always worth spending. So, how much does small business accounting services cost? The answer isn’t simple.

How Much To Pay For Bookkeeping Each Month?

The costs a small business incurs for bookkeeping depends on several variables; company lifecycle, its size, number of monthly transactions, how the payroll proceeds, number of expense accounts, credit card, invoices, etc.

In terms of the basic bookkeeping processes, your cost will get impacted by how the accounting systems, policies and procedures are set up and administered.

Schedule A Consultation Today!

Basic Bookkeeping Vs Full-Service Accounting

Small businesses in their early stages are concerned with compliance- paying bills, getting paid, recording transactions, following state and federal regulations.

At some point, the business will cross this threshold, and you will start emphasizing the need for timely, accurate financial reports.

It’s when you need more advanced bookkeeping, accrual-based accounting as well as management or managerial accounting to help take data-based decisions.

You may need to think between full-service accounting or basic bookkeeping services for small business. Note, the cost of full-service small business accounting is higher since it involves different levels of effort and expertise.

Basic- Bookkeeping Costs- Full-Time, Part-Time Or Outsourced

If basic bookkeeping is all that your business needs at a particular stage, you need to decide whether to do in-house bookkeeping or if you opt to outsource.

If you decide on managing and hiring a bookkeeper you will need to think whether the position is part-time or needs a full-time, experienced bookkeeper.

When you think of outsourcing, there are some ways to include local bookkeeping services, local CPA firms offering specialized business bookkeeping services.

Schedule A Consultation Today!

Which Bookkeeping Service Type Is Suitable For Small Business?

There are differences between three kinds of bookkeepers and what each can offer your business. Find out which works for your small business and start tackling problems, or potential problems, with your books.

How Much Does An Accountant Cost?

Accountant costs vary. Even companies having the same size and industry pay a different amount for accounting services. So, what are the expenses that go into accounting for small business?

Accounting Overhead Costs

Accounting, bookkeeping and payroll services expenses are part of the business’s overhead. Overhead expenses are costs that don’t directly turn into profits.

Though these costs don’t convert into cash, they are required to run your business. For instance, rent for your business location is overhead.

As a small business owner, try and keep the overhead cost low. The smaller the overhead costs, the more profits you can enjoy. You don’t want to cut corners but look for cost-effective solutions fitting the business needs.

How Much Does Accounting Cost A Small Business?

The accounting cost depends on the business’s size, industry, and bookkeeping methods. Though every company is different, there are average small business accounting costs and fees.

As per SCORE, most businesses spend $1000 each year on accounting administrative costs, legal fees, internal expenses, and more.

The typical accounting fees for small businesses fall under $1000 to $5000. If you are a new business owner, include accounting costs in the budget and if you are an experienced owner, re-evaluate accounting costs.

If you don’t want to spend your workday struggling with accounting and bookkeeping services, it is time to hire experts who excel in it.

Contact Us Today:

Locations:

9 Ideas For Effective Bookkeeping Services

Bookkeeping is an important part of your business to help you keep track of your business objectives in order to stay in line with your long-term business goals.

It is crucial to keep track of your cash flow, finances, taxes, and business health. Efficient bookkeeping services Beverly Hills helps in doing that by keeping track of the important aspects of your business.

Know how you can keep your financial books up to date to help you engage in informed decision making to help your business grow.

Open A Separate Business Account

The first step to effective bookkeeping is to separate your business expenses from personal expenses. So, it’s important for entrepreneurs to open a business account as soon as they begin their business operations.

Mixing your personal finances with your business finances will only lead to inaccurate bookkeeping and will waste enough time for the bookkeeper.

Ensure that you set up a bank account that also provides you with online banking access.

Schedule A Consultation Today!

Understand What An Effective Bookkeeping System Is

You need to introduce ways and methods through which you can improve your business’s bookkeeping processes, in order to do that you need to understand what an efficient bookkeeping system is.

An effective bookkeeping system is one that allows you to track important financial information effortlessly, protects sensitive company information and is updated on a regular basis.

Compile Business Documents

Keeping the business documents organized over time is a must for every business owner.

By keeping the financial documents organized, you can easily be able to track any query that may arise in the future and will also serve as evidence if the tax session approaches.

As per the tax departments, businesses are required to keep the tax-related documents and claims for at least 6 years.

Track The Cash Payments

Any cash that flows in as payment must first visit the business bank account before it’s spent. One may instantly payout their suppliers or vendors after getting cash in hand.

However, without getting paid in the bank account first it might lead to confusion and errors whilst tracking the transactions.

Moreover, there is a high risk that you or your bookkeeper might forget which customer has made the payment and which has not.

Also, you need to enter all expenses that are incurred in the account for enjoying potential tax reliefs.

In such cases, an expert offering QuickBooks bookkeeping services can surely help.

|

Have a huge business to look after? |

Keep The Bookkeeping System Up To Date

Businesses can sometimes run out of cash and accumulate huge debts; however, they can prevent this by ensuring quality monthly reporting and bookkeeping.

By keeping your system updated, the data becomes more really reliable and accurate which helps in informed decision making, helping prevent such situations.

Every business owner must try to get the books up to date every quarter, you can do this by hiring competent bookkeeping services.

Keep The Invoicing Game Up

An invoice is a document that confirms the payment that’s due from customers in exchange for goods and services that you’ve provided.

You need to ensure that you send out invoices to the customers as soon as a service is provided to ensure that cash is flowing in your business.

This will prevent any potential cash shortages in the future. As the CPA to confirm if the bookkeeping system they are setting up for you includes an invoicing system.

Pay Your Employees On Time

Your employees are life and blood of your business, so it’s your duty to pay them on time to keep them motivated. Always keep aside some cash to be able to cover payroll taxes.

To avoid any fines or penalties, make a habit to file your payroll on time and send out any payments that are due within the set time limit.

An experienced bookkeeping services Beverly Hills can help you meet the business’s payroll obligations safely and quickly.

Schedule A Consultation Today!

Track The Current Finances Regularly

It’s important to stay updated on the company’s financial standing and position in the market. You are advised to keep track of the finances flowing in and out of the business personally by making notes.

Think about what you have earned and what you’ve lost and note it on a piece of paper. You must cross-check this with your bank balance and address discrepancies that arise.

Note that effective and regular bookkeeping will make the process easier.

Use Suitable Bookkeeping Software

For small businesses, simple software that can perform the functions related to the cash book, general ledger, accounts receivable and payable and tracking business bank accounts would suffice.

However, you might need to purchase slightly more complex bookkeeping software as your business grows over time.

QuickBooks bookkeeping services are one of the most popular software. However, there are other options too. You must choose the right accounting service provider for assistance.

Contact Us Today:

Locations:

How Bookkeeping Best Practices Help You Achieve Business Success?

Managing personal finances doesn’t require much work. You may have at least one checking and savings account, a retirement account, a few investments and some monthly payments and a file to save tax record receipts.

Now, when it comes to bookkeeping and business accounting services, however, there are many things to consider and with employees and customers counting on you, the stakes are higher.

There are countless pieces of advice the accounting and bookkeeping service providers can give to small and medium-sized businesses.

Most bookkeeping services culver city experts agree that to achieve success, every business must adhere to the following practices:

Bookkeeping Practices To Implement:

- Keep The Personal And Business Finances Separate

- Establish Internal Controls

- Determine The Accounting Method You May Use

- Use Accounting Software To Track Expenses

- Track Employee Time If You Want To Understand Profitability

- Manage The Accounts Payable And Accounts Receivable

- Evaluate Financial Data Monthly

- Maintain Clean And Thorough Records

- Talk To An Experienced Consultant Regularly

Table of Contents

Keep The Personal And Business Finances Separate

Ensure you, or the employees aren’t buying things for personal use with business funds. If funds aren’t accurately allocated, it will quickly cause cash flow issues, as well as tax filing and auditing complications.

You may even suffer legal consequences where you lose the limited liability when you pierce the corporate veil by commingling personal and business financiers.

If you own a small business, then you are likely to handle all the purchases and payments yourself. Even though you might be the only person accessing funds, you must keep the personal and business finances totally separate.

Open up separate bank accounts and credit cards for your business. Not only will this be immensely helpful during tax time, but it also prevents you from forgetting the ream of paper you purchased was for your home.

Schedule A Consultation Today!

Establish Internal Controls

Another key bookkeeping services Culver City you must consider is establishing internal controls in your company’s policies and procedures to reduce the fraud risk.

This includes dual control for processes that involve making or receiving payments of any kind. For instance, you must have one employee write the check and another reconcile the bank account and a third sign to authorize payments.

Regarding internal control, the person who opens the mail, shouldn’t be the same person who’s responsible for accounting functions.

Determine The Accounting Method You May Use

There are two standard systems of business accounting services you can use, cash accounting and accrual accounting. Cash accounting records transactions at the time of cash actually changes hands and is usually only recommended if your business deals strictly in cash payments.

The accrual method uses the matching principle to record revenues and expenses in the period they occur, regardless of when payments are made or received.

This accrual method can sometimes be a bit complicated but is usually the best choice for businesses that will be invoicing clients.

Now, you must determine which system is appropriate for your business before you conduct your first transaction.

Use Accounting Software To Track Expenses

You must keep a thorough record of all the business expenses. This means saving and recording receipts on at least a weekly, if not daily, basis.

Without a solid core accounting software, daily bookkeeping tasks will put a lot of strain on your time. In the absence of technology, this burden will only become greater as your business grows.

When you determine which accounting software you will use, don’t simply consider whether it meets the current bookkeeping services Culver City needs. You should also evaluate each software and technology for its ability to scale with your business as it grows and your business needs to expand.

Track Employee Time If You Want To Understand Profitability

For service businesses, instead of entering timesheet information into the system by hand, you can choose to automate the processes.

With time-tracking and payroll automation by adopting an automated system for capturing project-related costs and employee time you can easily feed this information into your bookkeeping system.

Manage The Accounts Payable And Accounts Receivable

Make the most of your cash on hand by impeccably maintaining your AP and AR. Pay the right amount on time to avoid late fees and to take advantage of early payment discounts. You must send invoices promptly and follow up on any past due accounts to reduce days sales outstanding.

Evaluate Financial Data Monthly

Evaluate the back office from bookkeeping to management accounting by leveraging financial statements, KPIs, management reports, etc. Build a monthly reporting package that helps you understand the drivers of your profitability and business. Always remember this tip for bookkeeping services Culver City.

Schedule A Consultation Today!

Maintain Clean And Thorough Records

Talking of taxes and compliance, are you ready for an audit? After filing the taxes, you can’t toss out your old records and start a fresh new year. The IRS has established guidelines for the length of time businesses are expected to maintain copies of the tax returns and records, such as expense receipts, applicant information, payroll tax records. Now, the general rule of thumb is at least seven years, but the real requirement varies.

Talk To An Experienced Consultant Regularly

Keep a proper list of back-office questions and check in with your business accounting services company on a regular basis- not just at tax time- to get answers and advice. This will ensure you are always tax-ready at the year-end and will help you avoid huge money pitfalls.

Finally, hiring experts can ease the process of managing accounting and bookkeeping services. They use the best practices to help you achieve success.

Contact Us Today:

Locations:

What Does The Bookkeeper Do For Your Business?

Whether you sell enterprise software or legal advice, there are things the best bookkeeper guarantees about your business: you earn money and you spend it.

Bookkeepers are the professionals who help you keep track of all that. If you have been focused on getting the business off the ground, you may understand what the bookkeeper does.

Let us break down the day to day bookkeeping services, and why this is worth holding onto.

How Do The Bookkeeping Services Near Me Work?

Most entrepreneurs don’t have a financial background and had worked in corporate environments before commencing independent ownership.

These people are not bookkeeping experts and may not know the answer to the question of how bookkeepers work?

Good and experienced bookkeepers have certain important duties.

The bookkeeper’s duties always include a fair bit of data entry and receipt wrangling. They label expensed, indicate who you paid, how much you paid and keep records of receipts.

On the income side, bookkeeping services track incoming payments and sometimes issue invoices.

Bookkeeping is more than just dropping numbers into a spreadsheet. It takes meticulous analysis and just enough legal know-how.

The bookkeepers survive an audit by ensuring your records are in order and the deductions, legal. These experts prepare four important financial statements:

Balance sheet– this is a proper snapshot of financial position at one point of time

Income statement– showing the revenue and expenses over a stipulated time

Cash flow statement– the record of cash and cash-like hard equivalents entering or leaving your business

Statement of changes in equity- showing how the share capital, reserves and retained earnings changed in the reporting period.

What Can Bookkeepers Do For Your Business?

Why do you need bookkeeping services near me? If you have an experienced bookkeeper, you will reap these benefits:

- Peace of mind knowing the books are in place and tax season would not scramble

- Audit proof business with a thorough documentation

- Better budget decisions, knowing exactly where your money goes

- Understand the seasonal flow of business

- Audit proof business with a detailed documentation

When Do You Need To Hire A Bookkeeper?

When to hire a bookkeeper? You must bring in someone to handle the daily financial tasks right after you start the business. Then you could concentrate on running it- and doing what you can do best.

You can do the bookkeeping services yourself and save money. But at the same point, the vital business service will not get the attention it deserves. The paper and receipts will pile. Bills will get paid late. You also wouldn’t able to track expenses, etc.

If you struggle between taking care of your business and doing the bookkeeping tasks, it is time to think. This is exactly when you need to hire an experienced bookkeeper.

He would save your time, be helpful for your business, share insights and help manage cash flow.

How To Hire A Bookkeeper?

The first thing you must consider is if you need bookkeeping services near me. Next, decide if you need a full-time bookkeeping professional or a bookkeeper on a temporary basis.

You must select the bookkeeper from a renowned agency since who would be fit for your company. The bookkeeper must have excellent technical knowledge and proficiency.

How To Know If The Bookkeeper Is Doing It Right?

A good bookkeeper keeps the books clean and makes it easy for you to review and query the entry. Bad professionals leave the books in shambles and run away at the sign of an independent audit. It’s of no use hiring a bookkeeper you cannot trust.

For better transparency, accountability, you must focus on the interview questions to get an idea which candidates are reliable and honest:

- Can you tell a time when someone claimed credit for a work you did? What did you do then?

- Has your trustworthiness ever challenged? What was your response to the situation?

These questions will give you some insight into how the bookkeeper thinks and processed challenging scenarios professionally.

Bottom Line

If you are like most business owners, not interested in recording the details of every financial transaction, hiring a bookkeeper can help. Irrespective of your business size you can hire a bookkeeper.

Contact Us Today:

Locations:

5 Bookkeeping Mistakes That Can Cost Your Business A Lot

Bookkeeping for many is a kind of necessary evil but taking the evil lightly can cost you and your business a lot. Hereby one must take time to read this post to identify the mistakes that commonly happens during the bookkeeping process.

While doing the bookkeeping process, one must make sure that all the transactions should be recorded in a proper manner. One can use the software such as Quickbooks bookkeeping services. The current post is focused on some of the common bookkeeping errors which one must look out for.

Don’t mix Personal and Business Expenses

Suppose you are traveling and spend a certain amount of money. At the end of the year, you found that you are not being able to match the balance sheet as probably you forgot that you spend the money on a leisure trip and not on a business trip. But you mistakenly added it up in the business expense.

This is a small error but errors like this can cost you a lot in the long run. Therefore, when you are doing the bookkeeping, try to keep a vigilant eye on your expenses and entry the record in a proper way to avoid any foul of IRS.

Keep the Receipts intact

You have probably bought groceries for the office purpose and throw the receipt in the bin. After a few months when you will probably forget this incident a day will find that you are not being able to balance the accounts.

Thus, you can see that keeping small documents are also important. A small displacement of the receipts can create a huge issue for you. If you have a habit of ditching the receipts then you must keep them in place.

Not having different Bank Accounts

It is important that one must have separate bank accounts for both personal and professional matters. It helps you to keep the spending separate. Thus, when at the end of the year you will sit to calculate all the expenditure you do not have to look to different accounts and tally them one by one.

Additionally, it minimizes the margin of errors. Using QuickBooks bookkeeping services software can be helpful also.

Neglection of the sales tax

Often the small business owners used to avoid the matter of sales tax. Not addition the sales tax is one of the common bookkeeping issues. If you do not collect or report the sales tax properly you can be penalized or can be fined for the same.

However, a wrong entry can also increase the sales tax negatively.

No schedule Work

The bookkeeping task is a never-ending task. Expenses and transaction will run continuously. You may need to work weekly, monthly. Therefore, a bookkeeper must keep a vigilant eye on the transaction all the time and must record them. You can take the help of QuickBooks bookkeeping services.

Final Words

Therefore, you can see the most common mistakes that can happen during the bookkeeping. However, in case you are not being able to do bookkeeping by own, please feel free to contact us.

Contact Us Today:

Why does your startup need a bookkeeping service?

A startup is a transformation of an idea into a core reality. Several things an entrepreneur needs to take into consideration. Most of the entrepreneurs love to do work on own, but at some point, you may need to include outside people.

Especially, when it comes to managing the accounts, it is important that a knowledgeable person handle this matter. In most of the cases, the founders often do not come from the finance background.

However, a firm providing bookkeeping services in Santa Monica pointed out that small transactional miscalculation can create turbulence for your startup. Here are a few more reasons to hire a bookkeeping service.

• Stay out from what you don’t know

Most of the entrepreneurs are not aware of the intricacies of accounts and financial issues. Therefore, it is difficult for them to keep track of all the accounts related information. It will be a better idea to let these things to be handled by a knowledgeable person of this field.

It will diminish the chances of mistakes, which ultimately can save a good number of Dollars. A single missing bill can cost your business a lot.

• See your business from another view

It is difficult to find faults in your own works. Probably you are thinking that your business is running well but what is the harm in running it better?

A bookkeeper will bring forth all the transactional details in front of you. You can be able to see the fund sourcing and the expenses. Based on this, you can be able to calculate that do your efforts are really paying well or not.

• Pay the necessary bills on time

An entrepreneur needs to focus on the different aspects of the business. It is difficult to remember all the scheduled dates for the bill payments. However, if you hire a professional bookkeeper, it will be much easier to remember those things.

A bookkeeper will keep these little things in mind. Therefore, you don’t you need to take any extra burden on your shoulder.

• Correct filing of taxes

An audit or a tax claim can be a nightmare for a startup. It not only gives you a headache but also put a black mark on the business, which is not at all a good sign.

However, this generally happens if you forget to pay the quarterly taxes. You may need to file different taxes such as business tax payments, corporate tax payments, self-employment tax of 15.3%, 1099-MISC etc. Tax laws always get updated with each new year.

A bookkeeper can solve all these problems.

Final words

An entrepreneur needs to look after all the things of the business. Hardly they get time to be with their family. An extra burden of accounts can take that little too.

Hiring professional bookkeeping services in Santa Monica can give you some extra time to be with your family, while your works will be done in a scheduled manner.

Contact Us

Marina Del Address:

Why Hiring A Bookkeeping Service Is Essential

Bookkeeping services are an important part of running any small sized business, but it might happen that you been doing all the bookkeeping by yourself. Now, there are many disadvantages of doing the bookkeeping all by yourself. For instance, it might seem that you might be able to cut down the cost, however, it actually costs you more in the long run. Without expertise and proper knowledge, you would definitely not be able to do it yourself. This is exactly why you need bookkeeping services by experts.

Interestingly, there are signs that indicate when you must avail bookkeeping services for your business or why hire a bookkeeping services is essential. However, there’s one thing for sure, irrespective of the business size, availing bookkeeping services is essential. Here are some of the easy ways to spot when you need a bookkeeper for your business. After all, it is best to become jack of all trades at times.

You have little or no time for the business

You might have noticed that you are spending a lot of time doing the books. In fact, to that extent that it is actually eating up your time that you might have kept for creating new business leads or for planning. Since, you are always on the go, there is a tendency that you cannot keep up with the collection. This could be a disadvantage for you since it might affect the gross margin. Now, this could be a clear sign that you need to hire bookkeeping services Santa Monica.

Receipts are not be found anywhere

We know that you might be trying your best to keep up all the records in good condition. But you must accept that it can never be as perfect as you think it might be. Time is extremely valuable, therefore, keeping up with the little details is impossible. Your financials might be all over the place. The reason why you have started the whole thing is for running the business and definitely not to be a bookkeeper. There are tasks that are better left for the professionals. So, why take changes? Hiring a bookkeeper is what you need to do.

You lack prior experience

If you are not the type who prefers to keep it all organized, the paperwork is not at all for you. Bookkeeping services entails a lot of responsibility including paying proper attention to every detail. Now, accountants have higher rates than the bookkeepers, so even if the task is same you often end up hiring an accountant over the bookkeeper. What you need to do is understand who performs which task better and hire the right professional accordingly.

Also Read: 401k Retirement Plan Guidelines: Everything You Need To Know

You are not updated on tax laws

You are no longer sure as to how much your company actually spends on daily basis since the work has caught up with you. However, knowing how much the company spends gain a lot of importance. Tax compliance is important for running a business and by availing bookkeeping services Santa Monica you can actually stay updated without you having to do much.

Contact Us

Santa Monica Address: