4 Reasons QuickBooks Bookkeeping Is Necessary For Small Businesses

If you are a small business owner, you will find yourself having to take on various tasks outside the scope of a managerial role.

Some administrative tasks will involve accounting, preparing for tax seasons, and preparing taxes, etc. If you find yourself handling all tasks outside the scope of a managerial role, you need assistance.

Performing these tasks on your own becomes difficult as this is when you need proper bookkeeping services in the form of QuickBooks bookkeeping- the best bookkeeping software for small businesses.

Schedule A Consultation Today!

What Is Bookkeeping?

If you don’t already know, bookkeeping refers to the process of organizing and storing financial and accounting documents including journals, ledgers, financial statements, etc.

What Is QuickBooks Used For?

Avoid Audit By IRA

In 2013, the CRA (Canada Revenue Agency) dedicated the bulk of its program spending resources to small and medium-sized businesses, with $1.3 billion government spending on small and medium-sized businesses audit activities the upcoming year.

Do you want to avoid an audit altogether? It is easy. Keep track of your books regularly. If you want to be more prepared, pay attention to the red flags that the IRA notices in small business-like large business expenses, revenue discrepancies, etc.

Avoid The Stress Of Audit

Having the books in good order means you are well equipped for the unfortunate case that your books are audited by IRA. Since small business owners are at the highest risk for an IRA audit, proper bookkeeping becomes important than ever.

The more up-to-date and accurate your company’s books are, the quicker the IRA can move on from your case-leaving less time for headaches, more time for growing your business by using QuickBooks small business help.

How To Implement Proper Bookkeeping Services?

Better Management And Financial Analysis

To keep your business stay afloat, it needs money. We know that cash flow management isn’t an easy task.

Proper bookkeeping allows you to analyze and manage the cash flow. This gives you a better picture of your business’s financial situation.

Being the best accounting tool for small businesses, QuickBooks helps you keep on top of paying invoices to vendors in a proper fashion. Also, you must know where exactly the money is going. Who wouldn’t want to know where the money is going?

Hiring the right CPA can answer all your questions so you get the benefits of accounting software for small businesses.

Don’t Miss Out On Potential Tax Deductions

Slow and inconsistent bookkeeping can lead to missing legitimate tax deductions that you otherwise could have received.

Alternatively, the CPA could disallow your tax deduction based on missing paperwork, which you may have misplaced.

Keep in mind, as the general rule of thumb in any tax assessment the CPA is always right- unless of course, the records prove otherwise.

Finally, if you ask QuickBooks online good, the answer is YES. As bookkeepers are the unsung heroes of the financial world.

They make your money go round, keep your finances from becoming an unmitigated disaster, and ultimately help you manage your business with a clear head. Similarly, the QuickBooks features and functions help businesses function properly.

Contact Us Today:

Locations:

Stay Ahead with QuickBooks Desktop 2023: What’s New

The latest QuickBooks features enhance the performance and usability of it. It has simplified the process of selecting the right accounting software for small businesses. More than 2 million companies across the different states in the US use the QuickBooks.

40% of the total customers of QuickBooks online are small businesses. The latest version is the best QuickBooks for small businesses that include features such as Automated Payment Reminder, improved company snapshots, Bounced check, and many more.

The following are some of the latest features that will give the small business more power and flexibility to operate.

Schedule A Consultation Today!

1. Enhanced Reporting

The enhanced reporting structure offers better customization, usability, navigation, and presentation. Analyzing a specific report is crucial to plan the strategies for any business. A pile of the report files can make the owner confused.

The latest feature of QuickBooks small business accounting services allows creating customized reports by extracting only the required data. Further, real-time reports always show the updated changes without any additional manual efforts.

2. QuickBooks Cash

Think of a bank account that is customized to meet your needs. The latest QuickBooks Cash exactly does the same. It works like a no-fee business account that will offer you a fast payment, forecasting tools, and more. It automatically syncs with QuickBooks for continuous accounting.

Schedule A Consultation Today!

The following are some features:

- 1% APY interest

- Instant money deposit at no extra cost

- Cash Flow Planner enables small businesses to forecast the money for up to 90days

- Entry-free bookkeeping that automatically syncs the payments and spending

3. Improved Company Snapshot

The latest feature offers a centralized dashboard that helps you see all the critical business data at a glance. It can help you see the different data ranges of your business at a single view and layout.

Further, the template allows you to configure the data that you want to look at on the board without checking different reports.

4. Automated Payment Reminders

The latest QuickBooks online small business feature allows sending reminders to customers with due invoices, which helps you get due payments quickly. It saves plenty of time from following up on the late-paying customers.

Further, it also allows you the flexibility to customize the reminder for the specific customers. Hence, you can send reminders only to those customers who have a history of default payments.

Related Article: What QuickBooks Can’t Do?

5. QuickBooks Payment

The latest feature allows you to get the money directly in the account, almost instant. With this feature, a business can now preselect the day of a week when they want to make an automatic, instant deposit. You can do it thrice daily at 9 AM, at 2 PM, and 9 PM PT.

The overall process can help small businesses to get the payments receivable easily. All the payments will get directly transferred to your bank account. It will help you in managing your business cash flow.

Schedule A Consultation Today!

6. Easy Payroll Setups and Backdate checks

Managing the payrolls becomes easy, like never before with the QuickBooks. Recently, there is a 34% growth recorded in online services such as payments and payrolls of QuickBooks. The recent updates offer the ability to issue the backdate paychecks. The earlier version only allows creating checks for the current or future dates.

Additionally, it helps in reducing the time to set up the payroll by allowing the employees to complete the payroll setup. Small business owners can ask the employees to submit essential personal information directly to run the payroll.

7. 401k Plan Connected to QuickBooks

QuickBooks now connected with a new retirement 401(k) plan that will allow the small business owners to offer their employees a convenient and secure place to save. It is an affordable retirement platform, which will be available on the “Benefits” tab of the QuickBooks Online Payroll.

One can directly buy the plan from the QuickBooks account. The plans start from $39 and securely can be synced with QuickBooks payroll. It allows improved communication.

- Automatically checked eligibility and notified to the employees

- Auto deductions are taken out of paychecks

- Auto tracking of employee contribution

8. Introducing QuickBooks Commerce

QuickBooks introduced a business management platform naming QuickBooks commerce to help small businesses. With the help of the platform, small businesses can attract and sell across the different ecommerce platforms with an online storefront, marketplace, and POS system.

All the inventory, products, and orders are sync in a centrally run platform that will allow the small business owners to manage the omnichannel presence.

Bottom Line

Over in this post, you have seen how the latest QuickBooks features that can help the small business owners in various ways.

If you need help in choosing the right accounting software, or want to know how to set up a business in QuickBooks, please feel free to contact us.

Contact Us Today:

Locations:

Is QuickBooks Capable Of Replacing An Accountant?

Whether you operate a sole proprietorship or a large company, keeping tidy financial records makes it much easier to file your taxes each spring. You also need to track invoices and payments in order to handle potential client disputes, issue refunds, and understand how to budget effectively for the next year. Digital records make it easier than ever to store, manage, and analyze your records.

But can QuickBooks replace an accountant entirely? Not quite. QuickBooks stores and analyzes data for you, but you still need a human accountant to give you sound financial advice and to keep up with the latest changes in tax legislation. Here are some things QuickBooks can and cannot do for your small business.

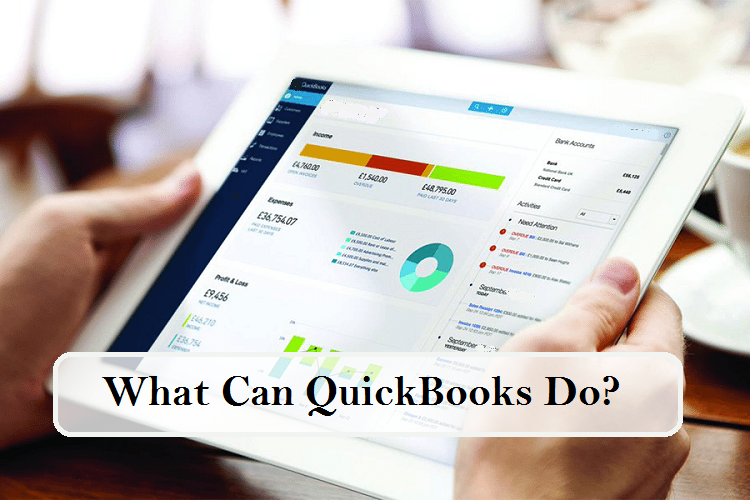

What Can QuickBooks Do?

Schedule A Consultation Today!

To understand the value of QuickBooks, it’s important to break down the differences between accounting and bookkeeping.

It’s true that QuickBooks has revolutionized bookkeeping for business, but is it actually sophisticated enough to replace professional accounting services? It’s understandable that, as a business owner, you want to save money wherever possible, but there are still quite a few financial processes that require the expertise of a knowledgeable human accountant.

QuickBooks is, at its core, a bookkeeping program. It can process your invoices, manage sales and expenses, track your employees’ time, and generate useful reports for budgeting and tax purposes. You can even pay bills and receive due date reminders.

While you might gain a lot of valuable accounting insights from QuickBooks’ balance sheets, profit-and-loss statements, and cash flow reports, the information you receive is still limited to raw data. And that’s the big distinction between bookkeeping and accounting.

Bookkeeping services Culver City helps you to keep your financial data in order; accounting takes things a step further, devising actionable recommendations and strategies based on historical data, missed opportunities, and sound financial principles. For that, you need the help of an accountant.

What QuickBooks Can’t Do?

Accountants use QuickBooks. CPAs use QuickBooks. Payroll managers use QuickBooks. The software is trusted by millions because it’s powerful and versatile, but it’s only as good as the person pulling the strings. There are several important things it cannot do.

-

Keep You In Compliance

-

Grow Your Business

-

Save Your Time

-

Correct Mistakes

QuickBooks is an excellent piece of software, but relying on QB alone can land you in hot water. For instance, tax legislation is constantly changing, and the program is seldom updated as quickly as the laws.

If QuickBooks bookkeeping services Culver City miscalculates your refund based on outdated tax rates or adjusts for a deduction that you no longer qualify for, you may find yourself fined or audited by the IRS.

That’s just one reason why it’s so important to work with an accounting professional who remains current on the guidelines and legislation.

More importantly, QuickBooks cannot guide the kinds of high-level financial decisions that will help you to grow your business. It can create some pretty impressive reports, like income statements that highlight correlations between revenue growth and specific expenditures.

But without an informed expert to analyze and interpret those reports, you can only guess at how the information might be used to improve your bottom line.

A knowledgeable accountant Playa Del Rey, and especially a certified public accountant (CPA), specialize in analyzing the minutiae. They identify the kinds of financial indicators that even the most intelligent software would miss, like the relationship between profits-and-losses and external market trends.

Schedule A Consultation Today!

Anyone can learn to use QuickBooks, but bookkeeping and financial analysis are time-consuming processes that demand a lot of attention. The more time you spend analyzing and breaking down financial reports, the less time you have to run your business.

The process also takes considerably longer for a non-professional than for someone who specializes in finance, so it’s just not an efficient use of your time.

Finally, QuickBooks is not error-proof. Even though it provides you with the tools to manage your finances and taxes, the onus is on the user to ensure that those tools are utilized properly and the data inputted correctly.

This can be extremely difficult for someone without a financial background. Consider that 60% of business owners admit to having an average to below-average understanding of accounting—and those are just the ones willing to admit it.

QuickBooks And Accountants Go Hand-In-Hand

Bookkeeping vs accounting always go hand in hand. By combining sophisticated accounting software with the services of a trusted CPA firm, you can ensure that your business:

- Remains in compliance with the IRS and other state and federal regulators

- Remains profitable and experiences steady growth over time

- Manages its income, expenses, payroll, and taxes as efficiently as possible

By sharing software access with your CPA firm, you’re able to manage the simple day-to-day recording duties while your accountant takes care of the big-picture work.

Cloud-based software systems have made it easy for CPAs and clients to share financial data in real time and ensure that all information remains current and accurate. Some CPAs even take things further, providing CFO and business management services to better serve their clients.

So, while software has become an essential part of the bookkeeping and accounting process, it will never replace the invaluable insight and discernment of an experienced accountant Playa Del Rey. The software is just the paintbrush and canvas; the accountant is the artist who brings the canvas to life.

Contact Us Today:

Locations: