Managing a small business may sound a small task, but it is exactly the opposite. One of the prime reasons behind it is the workload that a small business owner needs to handle. Among the different works, it is the accounts which remain neglected in most of the cases. Small business accounting is not difficult to manage if one will move systematically.

It is better to make a checklist if you want to handle your works all alone. Over here in this post, four different checklists are given that will help you to manage your accounts work without any kind of hassle. The accounting checklist is divided into five parts as follows:

- Daily Accounting Tasks

- Weekly Accounting Tasks

- Monthly Accounting Tasks

- Quarterly Accounting Tasks

- Annual Accounting Tasks

Here are the details of the checklist

Daily Accounting Tasks

Any business runs on the cash, and you cannot overlook the inflow and outgoing cash. It is important to check the cash amount that you have in your hand. Additionally, the checking helps you to understand what amount you are going to receive or need to pay to others. Keeping these in the mind daily can help you in maintaining day to day affairs.

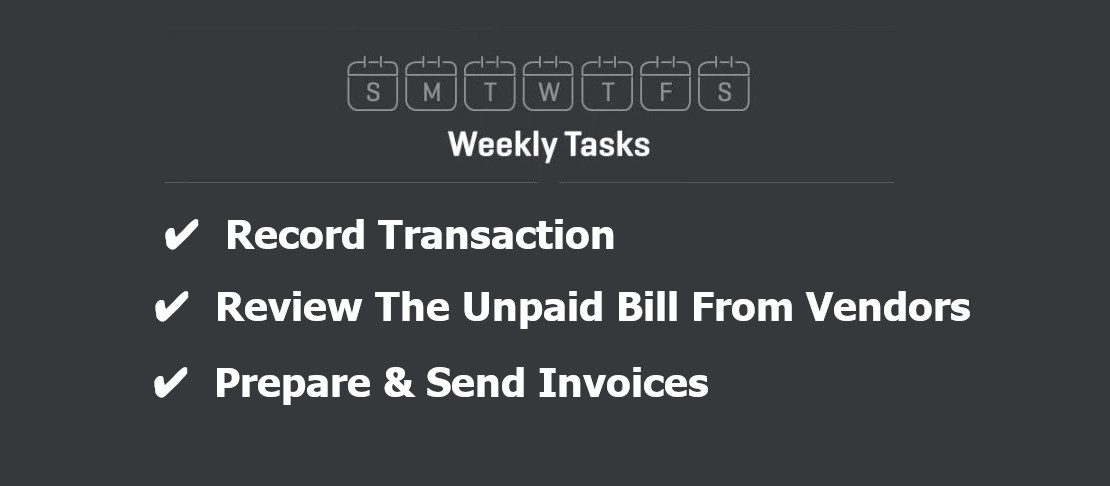

Weekly Accounting Tasks

Record Transaction

Recording all the transactions such as billing customers, receiving cash from customers, paying vendors, etc. are essential for small business accounting. You should keep the records at least weekly to ensure the smooth running of your business. Using bookkeeping can help you in this matter.

Review the unpaid bill from vendors

One must keep a separate folder for unpaid vendors. You should keep track of the amounts that are needed to pay. Few vendors offer a discount on early payments also.

Prepare and send invoices

You must ready all the invoices during the weekend. It is a good idea to prepare the invoices, and send them in the weekend as during the week you might remain busy.

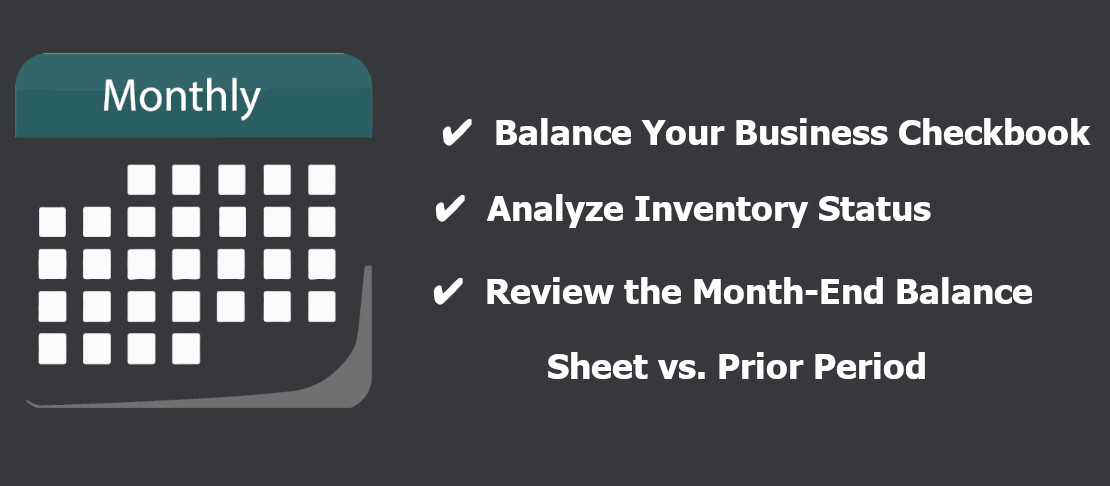

Monthly Accounting Tasks

Balance Your Business Checkbook

Once a month, you must look at the checkbook of the business. You will be able to understand that the cash inflow and other transactions are okay in that or not. You can also be able to know that all the transaction and entries are done in the right manner or not.

Analyze Inventory Status

In case you are having any inventory then you need to look at that at least once in the month. A regular check can help you in making the adjustments during small business accounting as you will neither have a shortage or overload.

Review the Month-End Balance Sheet vs. Prior Period

By checking the balance sheet of the current period with the early period, you can get a possible picture of the business that you are running. You can be able to point out where the business is lacking and can manage it.

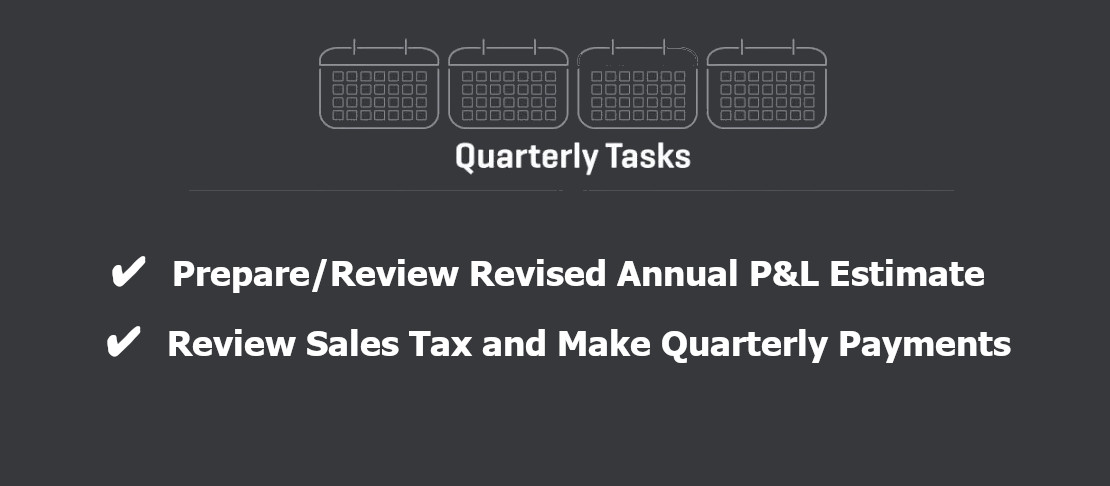

Quarterly Accounting Tasks

Prepare/Review Revised Annual P&L Estimate

You must revise and review all the annual estimation. You should also assert that do your assets are going up or down, the difference between revenues and expenses, etc.

Review Sales Tax and Make Quarterly Payments

You should also look in matters like tax and quarterly payments of the taxes. The U.S. Small Business Administration (SBA) can help you determine your state tax obligations.

Annual Accounting Tasks

Fill Out IRS Forms W-2 and 1099-MISC

You must fill and report the annual earnings of your full-time employees (W-2s) and most independent contractors (1099s). For any contractors who earned less than $600 a 1099 form is not required.

Review and Approve Full-Year Financial Reports and Tax Returns

You must check all the documents finally before you submit the tax returns finally. For a smooth small business accounting, you should hire a professional accountant who can help you in the tax preparation and internal accounting.